September 2023 Consumer Sentiment Index | Published: 22/09/23

Irish consumer sentiment slides in September on increased cost-of-living concerns

-

Consumer confidence drops to lowest level in six months

-

Rebound in oil prices, further rise in interest rates and gloomier economic outlook likely drivers of drop in sentiment

-

Negative ‘September effect’ likely boosted by prospect of increased spend on back-to-school, heating and countdown to Christmas

-

Special question focusses on consumers 3 key priorities for Budget ‘24

-

-

2 out of 3 consumers see cost-of-living supports as a key priority

-

1 out 2 consumers sees health as a key priority

-

2 out of 5 see housing as a key priority

-

1 in 4 sees reducing the tax burden on workers as a priority

-

1 in 5 sees significantly increasing Social Welfare rates as a key priority

-

1 in 7 sees addressing climate change as a key priority

-

1 in 7 sees providing support to mortgage borrowers as a key priority

-

1 in 9 sees preventing the Irish economy from overheating as a key priority

-

1 in 4 consumers expect Budget ’24 to provide a substantial offset to inflation pressures compared to 1 in 10 a year ago

Summary

The mood of Irish consumers darkened notably in September as a rebound in oil prices and a further rise in in interest rates threaten a renewed surge in living costs in the months ahead. Coupled with a somewhat gloomier economic outlook, the threat of a tough winter for Irish consumers appear to have increased markedly of late. As a result, consumer confidence slid to its weakest reading in six months.

Section I; Consumer sentiment cooling on cost fears.

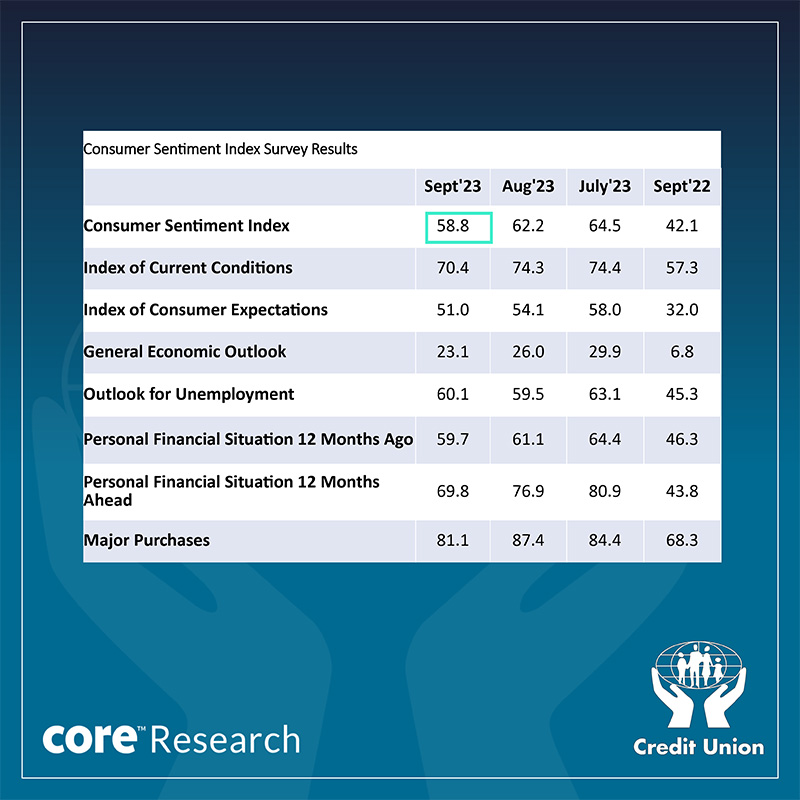

As the table below indicates, the September reading of the Credit Union Consumer Sentiment Survey (in partnership with Core Research) declined from 62.2 in August to 58.8 in September. As sentiment slipped 2.4 points in August, it appears that a weaker trend is now becoming established in a clear break from the pattern seen in the four months from April to July, that saw successive if modest improvements in Irish consumer confidence. The drop in August was sufficient to leave sentiment at its weakest level since March.

The 3.4 monthly drop in sentiment in September was largest since the sharp 11.3 decline recorded in September 2022. While there may be a seasonal influence at play, it should be pointed out that three of the previous five September readings posted monthly gains and only one posted a clear decline.

Our sense is that any adverse ‘September effect’ on sentiment is one of real substance rather than random statistical movements. The likelihood is that many Irish households are facing into seasonal spending pressures posed by ‘back-to-school’, heating bills and Christmas outlays. With inflation elevated and amplified further of late by higher oil prices and borrowing costs, it is scarcely surprising that consumer sentiment has moved onto a weaker trajectory of late.

Four of the five key elements of the Credit Union Consumer Sentiment Index posted weaker readings in September than in August. The exception was the outlook for the jobs market that saw a marginal bounce after declines in both the previous months notwithstanding still broadly positive data and news flow on employment.

Irish consumers were more negative about the general outlook for the Irish economy, likely reflecting some nervousness about the current momentum of the multinational sector prompted by weak export data for the second quarter and a surprisingly large fall in corporation tax receipts in August.

In tandem with poorer activity data for the Euro area and the UK through the survey period, this may have triggered a further downgrade in Irish consumer thinking about the prospects for economic growth in the next twelve months.

The pattern of responses to the survey segments on household finances and spending plans hint that consumers may be drawing some comfort from their capacity to weather the difficulties of the past year, but they are increasingly nervous about what might lie ahead.

It is not at all surprising that consumers were more downbeat about how their financial circumstances had changed in the last twelve months, but current cost-of-living pressures are not ‘new news’. As a result, the changes in responses to this question were modest in September.

The most notable negative changes in consumer thinking in this month’s survey relate to how household finances might change in the next twelve months and what that might entail for consumer spending plans.

Irish consumers were notably more pessimistic about the outlook for their household finances for the next twelve months in September. While slightly more consumers fear their financial circumstances will worsen in the year ahead, the most notable aspect was a near halving of the share of consumers who expect their personal finances to improve in the year ahead to just 1 in 20 of the consumers surveyed.

We think this probably reflects a material impact on many households financial circumstances of the recent rebound in oil prices and the further increase in interest rates. The scale of the change in sentiment may suggest how little ‘financial space’ large swathes of Irish consumers have to handle large and likely long-lasting increases in living costs.

The sense of substantial financial stretch among significant numbers of Irish consumers is also suggested by a marked weakening in spending plans in September. This change was driven by a rise in the number of consumers suggesting now is a bad time to make large ticket purchases. If this were to persist for the rest of the year, it would suggest the risk of a fairly cool if not cold Christmas for Irish retailers.

Is the sentiment survey still consistent with Irish consumer spending?

Of course, the drop in Irish consumer sentiment in September would be altogether less significant if the link between consumer sentiment and household spending has weakened markedly of late, as has been suggested in a number of commentaries such as recent articles in the Economist magazine (The pandemic has broken a closely followed survey of sentiment, Sep 7th 2023 and Economists and investors should pay less attention to consumers. Their thoughts can be misleading. Apr 27th 2023).

Various analyses of the topic, largely focussed on US consumer sentiment metrics, suggest that the link between sentiment and spending has been fundamentally changed by the pandemic and/or the marked change in the interest rate environment of late.

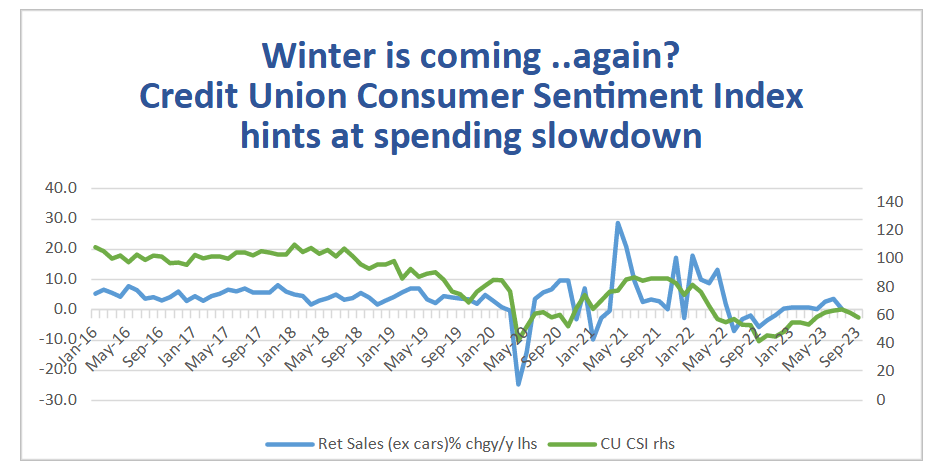

There is little doubt that dramatic developments in recent years, ranging from Brexit through a pandemic to the Russian invasion of Ukraine war in Europe have altered consumers financial circumstances and their thinking faced markedly but, as we noted previously, allowing for the distorting influence of ‘lockdowns’, the broad contours of Irish consumer sentiment and spending continue to move together.

For many if not most Irish consumers, the ‘fear factor’ and financial strains have both tended to move in a similar direction because elevated economic uncertainty and heightened job insecurity have coincided with a cost-of-living crisis notwithstanding the exceptional resilience of the Irish economy. As suggested by the diagram below, that traces the Credit Union Consumer Sentiment Index and the volume change in retail sales (excluding cars), sentiment and spending here have moved on broadly consistent paths in recent years.

In the same vein, the relatively downbeat tone of recent consumer sentiment readings seems entirely consistent with a meagre annual average increase of just 0.3% in the spending of the average Irish household through the past four or five years. As consumer sentiment measures the circumstances of the typical Irish consumer, we have to be very careful to take account of rapid growth in the number of people and households in Ireland in recent years, growth that is giving a material boost to overall spending.

Alongside notable variation in the circumstances of individual households, this aggregation issue that means there are more consumers spending rather than consumers are spending more goes some way towards explaining opposing anecdotes of famine and feast in terms of the current circumstances of Irish consumers.

Section II; What do Irish consumers think should be the priorities for Budget 24?

As usual, the Credit Union Consumer Sentiment Survey (in partnership with Core Research) included a couple of supplementary question. The September survey asked a representative sample of Irish consumers what they felt should be the priorities of the upcoming Budget ’24 which will be delivered on October 10th.

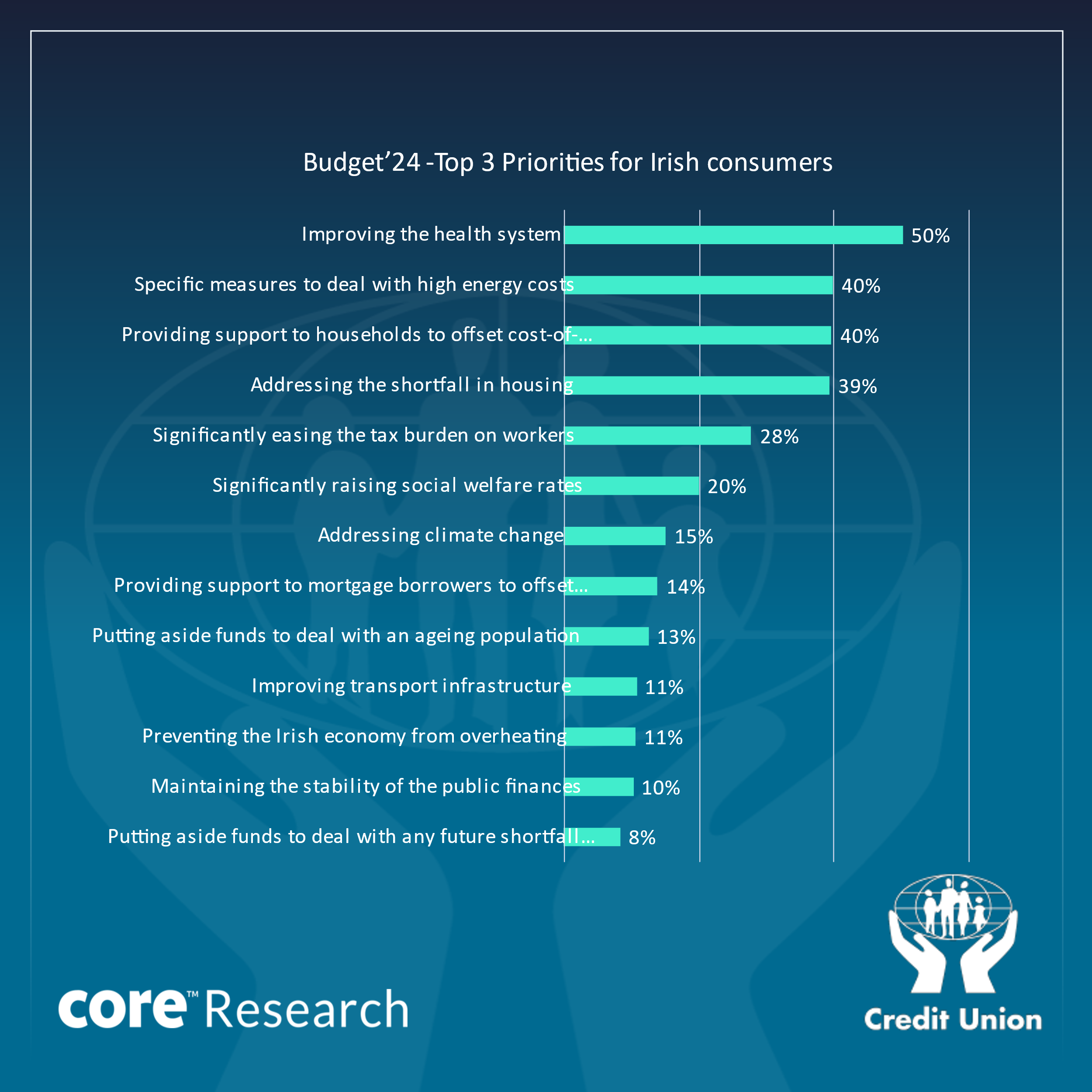

Consumers were asked to what they felt should be the three main priorities for the Budget package. So, the results shown in the table below show the number of consumers who gave each option as one of their three options. (Consequently, the responses sum to 300%).

As can be seen from the table, the most widely expressed priority for Budget ‘24, cited by 50% of Irish consumers, is to improve the health system. Behind this there is also broad support for measures to offset cost-of-living pressures and specific measures to deal with high energy costs-both cited by 40% of consumers. A very similar 39% of consumers suggest focussing on housing should be a key priority.

Coming somewhat behind these elements in terms of Irish consumers priorities for Budget ’24 are measures that may well attract much of the attention on Budget Day itself, a reduction in the tax burden which was cited by 28% of consumers and increases in welfare rates which 20% of consumers mentioned. It may be that these areas are not highlighted as a key priority by the majority of consumers because such measures normally feature in the Budget and/or they feel that more specific cost-of-living responses are warranted.

Coming some significant distance behind this second group of priorities were measures to address climate change, cited by 15% of consumers, support to mortgage holders, mentioned by 14%, and measures focussed on Ireland’s ageing population, highlighted by 13%.

Lagging modestly further behind this third group were measures focussed on improving transport infrastructure, indicated by 11% of consumers, preventing overheating, cited by a similar number, and maintaining the stability of the public finances, mentioned by 10% of consumers. In a similar vein, 8% of consumers highlighted putting funds aside to guard against a future shortfall in taxes.

It is not at all surprising that measures to address cost-of-living pressures are seen by the majority of Irish consumers as a key focus for Budget ’24. Some 40% of consumers want the Government to provide some offset while 40% want specific measures focussed on energy costs. Altogether roughly 2 out of 3 consumers (63%) want either one or both of these elements to be a key element of Budget ’24.

Perhaps the most surprising aspect of these survey responses was that half of the consumers surveyed (50%) highlighted health spend as a key priority for the upcoming Budget. Although health sector issues have been a longstanding problem and there has been some recent concerns about ongoing overruns in public spending on health, they were not a major media focus of late during the time the survey was in the field between September 5th and 14th . It might be suggested that Irish consumers take the view that this is an important structural issue for the economy and society and one that is readily amenable to a fiscal ‘fix’ in Budget ’24 given the particular strength of the public finances.

Another ‘structural’ issue attracting widespread support is the shortfall in housing. Although this is frequently seen in commentary as a more pressing issue than health, roughly 2 in 5 consumers (39%) indicated that that it should be a key Budget priority. It may be that a somewhat smaller if still substantial number of consumers cite this as a Budget priority because the scope for extra fiscal spend to markedly boost housing supply is unclear.

Although various budgetary options focussed on what might be termed ‘fiscal prudence’ attracted a measure of support, the broad message of the survey would seem to be that current cost-of-living pressures and structural strains in areas such as health and housing are seen as altogether more urgent and important in terms of the priorities for Budget ’24.

It is entirely understandable that consumers views in terms of the priorities for Budget ’24 are significantly influenced by their own circumstances. So, for example Health is seen as more important by older than by younger age groups and by females than by males. However, the difference in response rates across various groups is not dramatic. Nor is there any material difference on health between those making ends meet with difficulty and those making ends meet with ease. As might be expected climate change was more of a priority for those under 25 but it also got above average response rates from the over 55’s.

Again, while demographic differences were not pronounced, cost-of-living measures are more of a priority for those citing difficulty in making ends meet, those in middle age groups, females rather than males and consumers outside Dublin. Perhaps surprisingly, the priority attached to cost-of-living measures did not decrease as household income rose, suggesting strains on household finances are being felt right along the income spectrum.

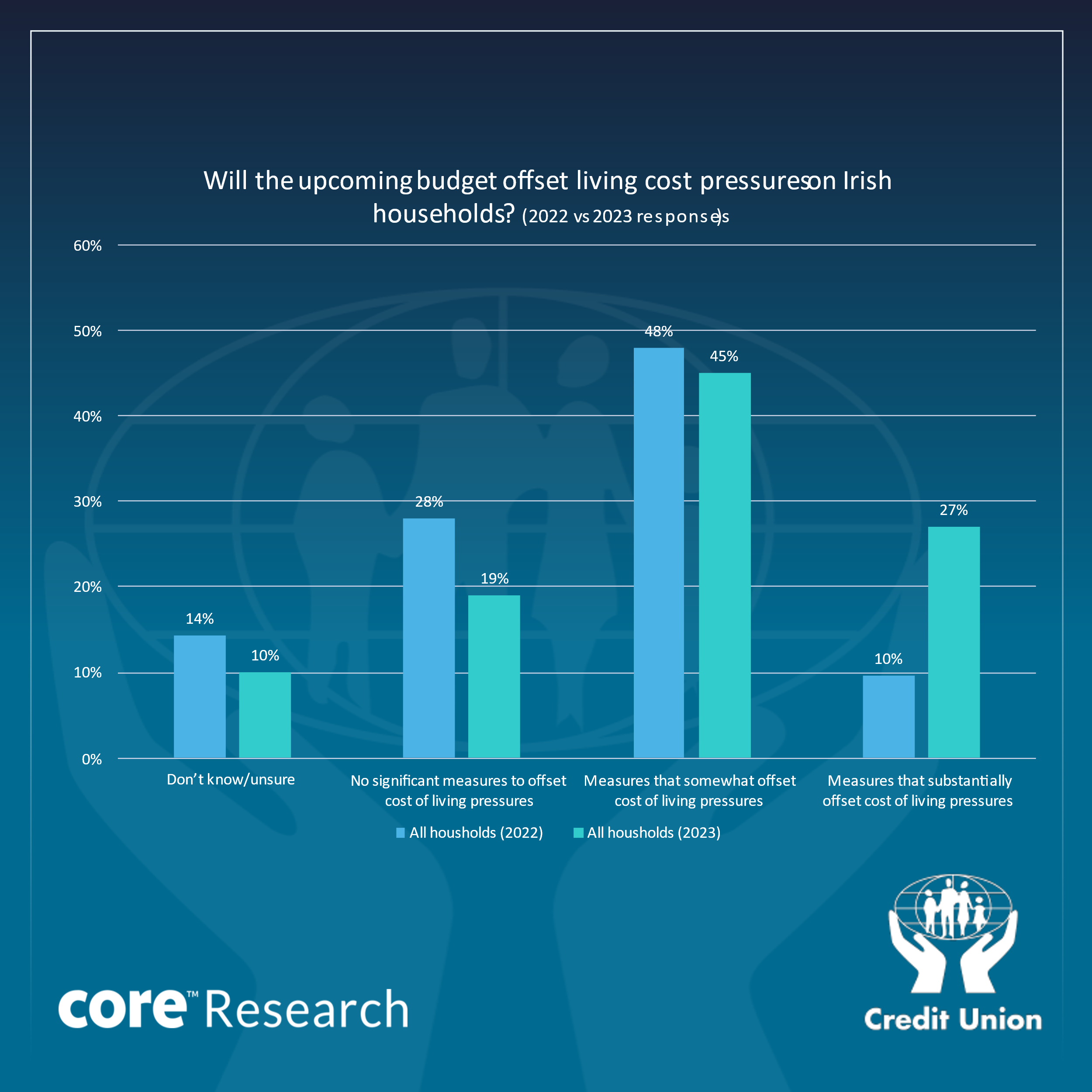

The September 2023 survey also replicated a question asked in September 2022 regarding the extent to which consumers think Budget measures will offset cost-of-living pressures. As the diagram below indicates, there is a notably greater expectation of substantive cost-of-living measures in the upcoming Budget than there was a year ago.

Roughly 1 in 4 consumers (27%) expect measures that will substantially counter cost-of-living difficulties compared to just 1 in 10 consumers (10%) a year ago. As recent official pronouncements have suggested the scope of this year’s measures will be clearly less than in Budget ’23, there is a clear mismatch between Government signalling and consumers’ sense of what Budget ’24 will contain.

Speaking on the release of September data and analysis, David Malone, CEO of the Irish League of Credit Unions noted;

“The details of the Credit Union Consumer Sentiment Survey emphasise the financial strains faced by many Irish households at present and highlight increasing concerns that cost-of-living pressures could intensify in the months ahead. Credit unions across the country will be on hand to support their members through these challenging times

The Credit Union Consumer Sentiment Survey is a monthly survey of a nationally representative sample of 1,000 adults. Since May 2019, Core Research have undertaken the survey administration and data collection for the survey. The September survey was live between the 4th and 14th September 2023.