July 2023 Consumer Sentiment Index | Published: 25/07/23

July confidence reading suggests Irish consumers feeling strengths and strains as inflation eats into optimism

-

Slight sentiment uptick driven by spending plans and healthy economy ….

-

….But consumers downgrade their views of household finances

-

So, recovery in sentiment continuing but constrained by cost-of-living concerns

Section I; A tale of many pressures and modest improvements

It isn’t the worst of times, it isn’t the best of times. While there is a tendency to describe current conditions to a ‘superlative degree‘ in terms of either boom or gloom, the Credit Union Consumer Sentiment Survey (in partnership with Core Research) for July paints a mixed picture of the circumstances now facing Irish consumers.

Irish consumer sentiment improved fractionally in July as holidays and summer sales likely encouraged a pick-up in spending plans. However, a slight pull-back in household financial circumstances suggests consumers remain cautious, implying restrained rather than runaway spending in the months ahead. Overall, the tone of the survey suggests that the pressures facing Irish consumers are fading but far from finished.

The Credit Union Consumer Sentiment Index (in partnership with Core Research) posted a marginal increase in July-increasing to 64.5 from 63.7 in June. This 0.8-point increase suggests no material change in Irish consumer sentiment in July but it does mark the 4th month in a row that sentiment has improved and the 7th gain in the past 8 months.

The ongoing recovery in sentiment from the 14 year low seen in September ’22 suggests consumer fears are continuing to ease. However, with the July sentiment reading of 64.5 still well below the pre-Ukraine war reading of 77.0 of February ’22, this month’s report also clearly indicates that any recovery has still some distance to go before it can be considered complete.

In this context, while the latest National Accounts data point towards a notably stronger trend in consumer spending than previously indicated, the cumulative change in household spending between the Pre-Covid Q1 of 20919 and Q1 2023 is broadly similar to the estimated increase in the population suggesting the purchases of the ‘average’ Irish consumer are only back at pre-Covid levels.

Survey details suggest Irish consumers seeing contradictory signals

The details of the survey also give a strong sense of an Irish consumer still being buffeted by strong economic and financial cross-currents in a very uncertain world. The July survey saw month-on-month increases in two of the five key elements of the Credit Union Consumer Sentiment Index following declines in these elements in June while the three remaining elements that weakened in July had all seen monthly gains in June.

The July survey saw a modest improvement in consumer thinking on the broad economic outlook. The survey period saw the publication of strong mid-year Exchequer returns and the Government’s Summer Economic Statement both of which heightened expectations of significant increases in public spending and income-supporting tax adjustments in the upcoming Budget.

In contrast, consumers were a little more cautious on the outlook for the jobs market in July. This could have been prompted by continuing concerns around the ‘Tech’ sector as well as the closure of Tara mines.

Irish consumers were a little more negative about their household finances in July, both in terms of their recent experience and prospects for the year ahead. Although inflation has continued to ease, the annual rate of 6.1% reported for June suggests cost-of-living pressures remain substantial. Moreover, a sequence of sharp increases in ECB interest rates is now adding an important additional source of pain and problems for a range of households.

It is also likely that holiday spending plans may have caused consumers to downgrade their assessment of their household finances in July. The detail s of the official inflation release for June saw package holiday prices up 43.2% year-on-year, airfares up 34.2% and domestic accommodation costs up 13%. Increases of this magnitude would undoubtedly put a significant hole in the holiday spending power of Irish consumers and could have adversely affected their assessment of their own financial circumstances.

With cost-of-living pressures still pronounced, the improvement in consumer thinking on the buying climate in July may appear surprising. The 6 point rise in this element of the survey was the largest since a 9 point increase in January and hints at a pronounced seasonal boost around winter and summer sales periods. In circumstances where household finances are depleted but not entirely distressed, the lure of the discounted ‘bargain’ in summer sales may be significantly enhanced.

In the same vein, as evidenced by responses to the special question on holiday spend in the June Credit Union Consumer Sentiment Survey, although many consumers may curb their holiday spending, a meaningful break from current pressures may become more of a priority for those with the leeway to afford a holiday this year.

The corollary of these interpretations is that consumer spending may remain constrained and careful through the balance of 2023 until a fair measure of current uncertainties and financial pressures ease.

Section II; Where do Irish consumers think inflation is headed in the next 12 months and what factors may drive it there?

Cost of living pressures are a critical driver of consumer sentiment and spending power in Ireland and elsewhere at present. While inflation has moderated somewhat of late, at 6.1% in June 2023, it remains very high by the standards of most of the past decade (the average annual inflation rate over 2013 to 2022, including the outsized increase of 7.8% in 2022 was just 1.2%).

In recent months, the ECB and other central banks have increasingly emphasised the threat that high inflation could become a persistent feature of the economic landscape (and warned of the likely need for materially higher interest rates in response). One important factor that could lead high inflation to last longer would be if rapid recent inflation gets built into expectations of future inflation, in other words, if sharp increases in prices come to be seen as a normal feature of economic life.

To get some sense of the risks in this regard, the Credit Union Consumer Sentiment Survey for July (in partnership with Core Research) contained a couple of supplementary questions focussed on Irish consumers thinking on the outlook for inflation.

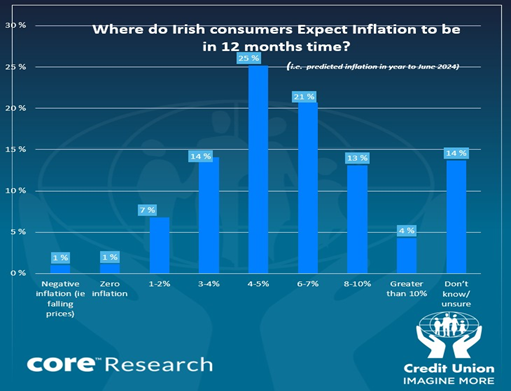

First of all, consumers were asked where they thought the rate of inflation in Ireland would lie in twelve months’ time i.e. in the year to June 2024. The question was framed by noting that in the year to June 2023, Irish inflation was approximately 6%. The responses given are shown in the diagram below;

As the diagram illustrates, the most common view was that inflation would be in the 4-5% range in a year’s time but, around this mode, somewhat more consumers expected a higher rather than a lower inflation outturn. In terms of a specific number, the inflation rate for the next twelve months expected on average by Irish consumers can be taken as either the median which we estimate at 4.8% or the mean at 5.5%. Given the degree of uncertainty about the future, we would caution against any spurious precision in this regard and suggest that Irish consumers think inflation next year will be around 5%.

Some Technical Details

As most domestic forecasters envisage Irish inflation will be in a range of 3 to 4% on average in 2024, the Credit Union Consumer Sentiment Survey suggests Irish consumers are a little more pessimistic about the future pace of easing in price pressures. However, the evidence from consumer inflation surveys globally is that consumers tend to exhibit some upside bias in their inflation estimates.

That said, given the degree of uncertainty around the longer term trend in inflation following the recent surge, the gap between Irish consumer thinking and that of economic forecasters is relatively modest. The fact that the consumer inflation estimate is for June 2024 and inflation is expected to drop through next year would narrow the gap further as would likely upside risks around the impact of interest rate increases.

The Credit Union Consumer Sentiment Survey’s estimate of Irish consumers expectations for inflation of around 5% is moderately lower than an estimate of 6.1% in a similar consumer expectations survey for May reported in the Latest Central Bank bulletin (CBI QB 2/23 P83) but it is consistent with a continuing drop in inflation expectations-the previous CBI figure for February was 7.2%. It should also be noted that CBI survey asks a more open question and some respondents to that survey report notably higher inflation estimates than those seen in the Credit Union Consumer Sentiment Survey.

Irish consumers expectations for inflation may also appear somewhat higher than those of Euro area consumers in general-according to the ECB, the mean inflation expectation of consumers across the Euro area for the twelve months to May 2024 is 5.1% while the median is 3.9%.

However, it is likely that Irish consumers focus on the most commonly reported domestic inflation figure, a measure that is currently being significantly boosted by rising mortgage costs (that aren’t included in the harmonised European inflation figure- in June 2023, Irish CPI inflation was 6.1% whereas on the harmonised measure it was 4.8%). Taking this into account, it could be argued that Irish consumers expect marginally lower inflation than their counterparts across Europe, a view that could be informed by comparatively low Irish inflation prior to the recent surge.

Inflation concerns vary widely across Irish consumers

It appears that Irish consumers expect a clear, if limited, easing in inflation in the year ahead. However, in line with international studies of consumer inflation expectations, there is quite a large variation in consumer thinking and some distinct demographic differences.

In broad terms, younger consumers are notably more likely to expect lower inflation than older consumers. Those aged under 45 were about twice as likely to see Irish inflation at 2% or lower in a years’ time than their older counterparts. Hower, the share of consumers seeing inflation at 6% or higher was broadly similar in the two age groups, suggesting views diverge more among younger age groups.

Female respondents were somewhat more likely to expect higher inflation and slightly less likely to predict lower inflation but the most notable gender difference was that uncertainty about the inflation outlook was notably less pronounced among males than females; female respondents were two and half times more likely to respond that they didn’t know or were unsure about the inflation outlook than their male counterparts. While gender differences weren’t dramatic, they may be informed by variations in income as well as familiarity with many aspects of household running costs.

Those consumers who say they have difficulty making ends meet were twice as likely to say they expect inflation to be 8% or higher as those who say they are managing without difficulty. However, unlike various international studies on consumer inflation expectations that tend to find higher inflation predictions are more prevalent among consumers with lower incomes and educational qualifications, there was little evidence of clearly different predictions based on income or education in the July sentiment results.

We would interpret this as a reflection of the particular nature of the inflation ‘shock currently being experienced by Irish consumers. Although lower income households are clearly more vulnerable to sharp increases in food and energy bills, the universal nature of such spending allied to the recent surge in borrowing costs means the vulnerability of households on traditional socioeconomic grounds may not be completely clearcut.

What do consumers think will be the key drivers of inflation in the year ahead?

We then asked consumers what they thought would have the biggest impact on Irish inflation in the next twelve months. The responses shown in the diagram below suggest consumers see cost of living pressures concentrated in three key areas, energy, food, and housing.

Although global energy prices have eased of late, it is not entirely surprising that this is seen as the most important inflation driver. The scale of increase seen in the past couple of years, coupled with substantial uncertainty around the outlook through the coming winter both in terms of global factors and local retail pricing, means that energy costs remain central to consumer thinking on inflation prospects.

Housing costs rather than ‘overheating’ seen as a key inflation concern

In light of the intense focus on grocery prices through the past year, it may seem surprising that broadly similar numbers of Irish consumers see food and housing costs as the key driver of inflation over the next twelve months. Again, the details of the official inflation data for June 2023 hint at why that might be the case. Food accounts for 9.4% of Irish consumers spending and food prices were 10.1% higher than a year ago in June whereas rent and mortgage costs account for 11.1% of consumer spending and these costs were 17.4% higher than a year earlier.

In addition, with a shortfall in housing now a perennial feature of the Irish economy and the ECB recently signalling its intention to implement a more aggressive rise in interest rates than had been expected, the contrast between strong upward momentum in housing costs and recent high profile ‘discounts’ from grocery retailers is notable. Indeed, there is an unwelcome irony in the fact that one in four Irish consumers think the ECB’s policy actions to rein in inflation could be an important driver of Irish inflation in the year ahead.

Not surprisingly, concerns about housing inflation were more prominent among younger survey correspondents. Respondents from Dublin and the rest of Leinster also tended to be more concerned about this issue. Among consumers citing housing costs as the main inflation threat, there was little difference between those saying they were currently having difficulty making ends meet and those indicating they were not having difficulty. Likely reflecting broader housing affordability issues, housing cost concerns were more prevalent among with consumers with higher reported incomes.

In recent pronouncements, the ECB president, Christine Lagarde, and some other key officials have emphasised the threat of wage-led inflation. As just 7% of Irish consumers see wage costs having the largest impact on Irish inflation in the year ahead, widely reported risks in this regard may be overstated according to Irish consumers.

The relatively small number of consumers who see wage growth as the likely key inflation driver seems to suggest that there is no broadly based expectation of a sharp acceleration in wage growth domestically notwithstanding a buoyant Irish jobs market. This result would also seem consistent with the relatively downbeat assessment of household finances in the body of the sentiment survey.

Although the early part of 2023 saw a significant focus on the role played by a marked increase in profit margins in the pick-up in inflation, some high-profile grocery price cut announcements and greater scrutiny of firms pricing behaviour seems to have reduced Irish consumers expectations that ‘profiteering’ will be a major driver of inflation in the year ahead. As a result, just 5% of consumers think this could be the main driver of future inflation.

In general, the responses given by Irish consumers to the question in relation to the drivers of inflation suggest that cost of living pressures are seen focussed on a few key areas. The concentration of responses in relation to inflation drivers suggests that Irish consumers do not see inflation in terms of an ‘overheating’ Irish economy story.

Rampant energy and food costs are essentially a global story as is the rise in interest rates. The emerging importance of higher borrowing costs as an additional source of pressure on household finances is also a complicating factor in terms of calibrating the scale and spread of fiscal support measures in the upcoming Budget.

The Credit Union Consumer Sentiment Survey is a monthly survey of a nationally representative sample of 1,000 adults. Since May 2019, Core Research have undertaken the survey administration and data collection for the survey. The July survey was live between the 7th and 14th July 2023