June 2023 Consumer Sentiment Index | Published: 26/06/23

Consumers sense financial pressures are easing, albeit far from over

- Confidence marginally better in June, but still signals a cautious Irish consumer

- Sentiment likely boosted by tentative signs that peak price pressures may be behind us, but survey suggests strains still substantial

- Improved thinking on household finances could also reflect some weather impact…

- …But pull-back in spending plans suggests pronounced ‘feel-good’ factor remains absent

- Special questions suggest holiday spend will be hit by cost-of-living pressures

- 27% of Irish consumers say they can’t afford a holiday

- 30% say cost of living pressures will curb their holiday spending

- But 25% say cost-of-living crisis won’t affect their holiday spend..

- …and 8% say they will spend more because their need for a break is greater

- So, cost pressures mean very different things to different consumers in terms of their holiday spend

Section I; Consumer sentiment slightly better in June, but financial clouds still blocking the sunshine

Irish Consumer confidence improved marginally in June. Tentative signs that food and energy price inflation might have peaked seem to have encouraged a slight easing in concerns around household finances. At the margin, exceptionally good weather may have boosted the mood of many consumers, but the modest monthly gain suggests financial clouds are still hanging heavily over many households and economic ‘sunshine’ is still hazy for most.

While the June sentiment reading marked the sixth monthly gain in seven months, the general tone of the survey suggests that although concerns are easing, they are far from over. The details of the June survey indicate that consumers are still cautious about their own financial circumstances and the broader economic outlook. In this context, a reported pull-back in household spending plans emphasises that cost-of-living pressures remain a key concern for many Irish consumers.

The Credit Union Consumer Sentiment Index (in partnership with Core Research) increased to 63.7 in June from 62.4 in May. This marginal gain suggests no major change in thinking this month and might best be regarded as signalling an ongoing-albeit limited-easing in the cost-of-living concerns that depressed sentiment and drove the index to a 14 year low of 42.1 as recently as September 2022.

The small improvement in the Credit Union Consumer Sentiment Survey in June reflected gains in three of the five elements of the sentiment index offset by declines in the other two. There were contrasting movements in the two ‘macro’ elements of the index, with a modest further upgrade of the outlook for employment which more than compensated for a small downgrade of the general outlook for the Irish economy. Both changes were reasonably limited suggesting that developments through the June survey largely chimed rather than clashed with previous thinking.

While the June sentiment survey period saw some high-profile redundancy announcements, consumer thinking on the health of the Irish jobs market appears to have been bolstered by a continuing stream of new job announcements and some exceptionally strong official data. Numbers at work in the first quarter of 2023 were reported to be 103k higher than a year earlier and the unemployment rate for May was estimated at 3.8%, the lowest number in thirty-five years of monthly jobless data.

Consumers assessment of the general economic outlook weakened marginally in June after a notable upgrade in May. Ongoing uncertainty about global economic prospects, contrasting views on the correct setting for domestic fiscal policy and a further ECB interest rate increase during the survey period likely contributed to a still dominant view that the year ahead will remain challenging.

The June survey period saw widespread media reports of forthcoming cuts in energy costs as well as high profile announcements of cuts in some retail food prices. With headline inflation also easing further, the relevant news-flow likely prompted a view that the intensity of price pressures seen through most of the past year may be past its peak. These developments meant consumer thinking on both past and prospective household financial circumstances improved clearly but still cautiously in June. As noted previously, consumers may sense that the pace of increase in consumer prices may be slowing but they know it remains rapid and well above the pace of income growth for most Irish households.

Extremely warm and sunny weather through the survey period may also have helped boost sentiment, but previous work failed to find a clear and consistent correlation between weather conditions and Irish consumer sentiment-probably reflecting the very variable nature of the Irish weather that means the average monthly sentiment reading typically encompasses a wide range of ‘sunny spells and showers’.

In principle, good weather might be expected to affect consumers views of their own circumstances rather more than their assessment of ‘macro’ conditions which are both more distant and more clearly defined. At the margin, good weather at home may also mean some consumers feel they don’t have to spend on an expensive holiday. So, we can’t exclude some positive weather impact on the June reading. That said, the still very subdued level of the Credit Union Consumer Sentiment Index suggests that a marked weather-related ‘feel-good’ is sorely lacking.

With nearly four times as many consumers still reporting a deterioration in their household financial circumstances as are reporting an improvement through the past twelve months and roughly three times as many negative responses as there are positive responses in relation to expectations for the next twelve months, it is hardly surprising that spending plans are still constrained.

The June sentiment survey saw a further pull-back in the buying climate that likely reflects the impact of a severe and extended period of cost-of-living stains on many households. Consistent with this ‘downbeat’ view in relation to spending plans, official data show that, notwithstanding some recent improvement, the volume of Irish consumer spending was effectively unchanged over the past four years (+0.2% in Q1 2023 from its pre-Covid level of Q1 2019.

Section II; Will cost-of-living difficulties hit holiday spending?

As normal, the June Credit Union Consumer Sentiment Survey contained a couple of special questions. This month, the special questions focussed on planned holiday spend and the impact of cost-of-living pressures on that spend.

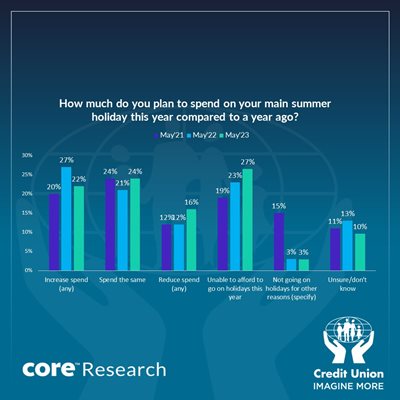

As diagram 1 below indicates, similar questions have been asked in the Consumer Sentiment Survey in recent years. However, it should be noted that responses to these questions were previously influenced by pandemic-related constraints on travel and pent-up demand for holidays once those constraints eased.

The responses shown in the diagram above are consistent with the evidence of previous special questions in highlighting marked differences in the circumstances of individual consumers. On balance, however, it seems that main summer holiday spending will be curtailed somewhat this year. The balance between those consumers planning to spend more and those planning to spend less, is less positive than in previous years (+6 in 2023, +15 in 2022, +8 in 2021). In the same vein, the number who say they cannot afford to go on holidays has risen to 27% (the largest share of responses) in 2023 from 19% in 2021 and 23% in 2022.

Not surprisingly, in the June 2022 survey, those on lower incomes were markedly more likely to say they couldn’t afford to go on holiday this year. In this context, those reporting difficulties in making ends meet were 7 times more likely to say they couldn’t afford a holiday than those reporting no difficulties of this sort. Younger respondents were less likely to report this difficulty but middle-aged respondents (those aged 35-64) were also somewhat more likely to respond that they couldn’t afford a holiday with difficulties tending to rise with age and peaking among those aged 55 to 64, before declining materially among those aged over 65.

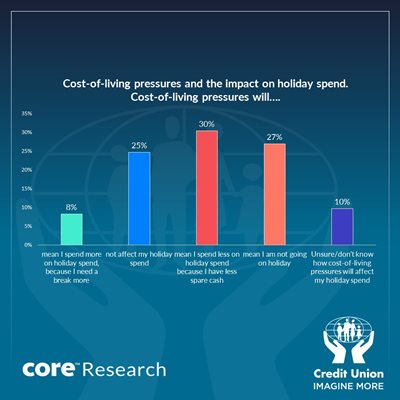

The June Credit Union Consumer Sentiment Survey (in partnership with Core Research) also asked a specific question regarding the impact of cost-of-living pressures on holiday spending plans. The responses to this question are shown in the diagram below.

In contrast to the other special question regarding holiday spend discussed above, this question focussed on how cost-of-living pressures had affected holiday spending plans. As a result, the responses do not focus on a year-on-year comparison of holiday spend but instead ask how plans now compare to circumstances in which cost of living plans were not a constraint.

A small but not insignificant 8% of consumers reported that they planned to increase their holiday spending because they felt needed a break more because of the strain of cost-of-living pressures. These responses were more prevalent among younger consumers and, perhaps surprisingly, didn’t differ markedly among those reporting difficulties making ends meet and others.

A further 25% of those surveyed say cost-of-living pressures will not affect their holiday spend. Not surprisingly, this response increased progressively with income. Those reporting difficulty making ends meet were almost 5 times less likely to give this response. Consumers aged over 65 were much more likely to say their holiday spend would not be affected by cost-of-living pressures. This could be because of carefully budgeted outlays or, in instances, could reflect accumulated wealth. Again, this highlights the importance of avoiding sweeping generalisations about Irish consumers or even particular demographics within consumers.

Some 30% of consumers say they expect that cost-of-living pressures will reduce the amount they will spend holidays this year (compared to what would otherwise be the case). This response was more prevalent among younger consumers, among those reporting difficulty making ends meet and among ‘middle income’ consumers.

27% of those surveyed say that cost-of-living pressures mean they are not going on holiday this year. Not surprisingly, this number is comparable with the 27% who said they cannot afford to go on holiday in response to the other special question asked this month and mated the demographic profile of those responses.

In broad terms, the responses to the two questions on planned holiday spend suggest cost-of-living pressures will have a material negative impact on holiday uptake and outlays this year. Aggregating those cutting back and not taking a holiday suggests roughly two-thirds of those consumers whose circumstances are clear (i.e. excluding don’t know/unsure) will curtail their holiday spending because of cost-of-living pressures. However, this implies just over one in three Irish consumers feels their financial circumstances are still sufficiently robust that they don’t plan to cut back holiday spending.

The Credit Union Consumer Sentiment Survey is a monthly survey of a nationally representative sample of 1,000 adults. Since May 2019, Core Research have undertaken the survey administration and data collection for the survey. The June survey was live between the 6th and 16th June 2023