January 2024 Consumer Sentiment Index | Published: 01/02/24

-

Credit Union Consumer Sentiment Index posts largest monthly gain in over 3 years

-

Falling energy prices and talk of grocery ‘price war’ ease cost-of-living concerns

-

Christmas/New year ‘switch-off’ from economic and financial news also contributes normal seasonal bounce

-

Sentiment Index still below levels seen before Russian invasion of Ukraine, so caution still prevails

-

Special questions focus on consumers 5-year outlook for the Irish economy and their own household finances

-

Consumers split on whether Irish economy will be stronger or weaker in 2029

-

40% of consumers expect stronger household incomes in 5 years’ time but 23% expect their incomes to be lower

-

68% of consumers think Irish house prices will be higher while just 14% see lower house prices on a five-year view

Speaking on the release of the January data and analysis, David Malone, CEO of the Irish League of Credit Unions noted; “The sharp improvement in Irish consumer sentiment in January suggests many consumers expect an easing in cost-of-living pressures and some increase in their incomes in the year ahead. While this would mark a clear break from difficulties of recent years, the details of the survey suggest consumers are understandably cautious in their outlook and their spending plans”.

Summary

The mood of Irish consumers improved markedly in January as falling energy prices and announcements of grocery price cuts suggested 2024 could see some reversal of the cost-of-living pressures of the past couple of years.

In addition, tax data and recent forecasts pointed to a resilient Irish economy while a lengthy Christmas break during the survey period likely prompted a seasonal ‘switch-off’ from economic concerns. As a result, Irish consumer confidence posted a sharp increase in January to its best level in two years.

Although there are grounds to expect that many Irish consumers will see gradually improving circumstances boost sentiment and spending in the year ahead, a still challenging economic and financial backdrop suggests that consumer confidence metrics are most unlikely to see straight line gains through 2024. Indeed, it would not be surprising to see some pull-back in sentiment in coming months as a difficult global outlook comes into focus, Christmas spending bills bite and serve to emphasise continuing pressures on the finances of Irish households.

Section I; Irish consumers see reasons to be cheerful-or at least less fearful in January

The Credit Union Consumer Sentiment Index (in partnership with Core Research) rose sharply in January, signalling a major uplift in consumer thinking as well as reinforcing the trend improvement in Irish consumer confidence suggested by successive gains through each of the previous three months.

The Credit Union Consumer Sentiment Index (in partnership with Core Research) increased to 74.2 in January from 62.4 in December. This unusually large 11.2 point monthly gain was the strongest since November 2020 when hopes of a Covid-free Christmas sparked a 12.9-point increase. The January 2024 sentiment reading put Irish consumer confidence at its highest level in almost two years (February ‘22 77.0) when Russia’s invasion of Ukraine dramatically darkened the global outlook in so many ways.

Although we would emphasise the encouraging nature of the pick-up in the latest reading of Irish consumer confidence, we should also point out that at 72.4 it remains some distance below the now 29-year history of the sentiment survey. As such, the latest Credit Union Consumer Sentiment Survey (in partnership with Core Research) suggests that Irish consumers sense conditions are clearly improving but they are also still signalling significant strains from a testing economic backdrop and continuing pressures on their household finances.

We would also highlight a perhaps surprising ‘January feelgood factor’ element that likely contributed to the scale of improvement in the sentiment reading this month. While the sentiment index does not exhibit a regular seasonal pattern overall, there has been an increase between December and January in fourteen of the past fifteen years-the exception being January 2021 when fears of a second Covid-19 surge prompted a sharp weakening in the January report.

In broad terms, we tend to attribute the regularity of gains in January readings to a seasonal switch-off from economic and financial headlines and concerns during extended Christmas and New Year ‘downtime’ with family and friends. It is often the case that some element of January gains is reversed in the months that follow.

The sharp improvement in Irish consumer sentiment in January was mirrored in strong gains in the comparable indicator for the US which posted a slightly smaller monthly increase but one which was sufficient to boost US consumer sentiment to its best level in two and a half years. In the case of US consumers, a roughly 20% drop in gasoline prices in recent months is seen as a key pointer towards a reversal of earlier inflation pressures while the resilience of the economy is reflected in persistent jobs growth and low unemployment.

Consumer confidence also rose in the UK, reaching a two-year high, reflecting the promise of tax cuts and expectations for lower interest rates as well as a softening in inflation. In contrast to developments in Ireland, the US and the UK, consumer confidence fell modestly in the Euro area, suggesting weak economic performance and elevated living costs remain problematic for consumers in the single currency area.

As the table above indicates, all five main elements of the Credit Union Consumer Sentiment Survey (in partnership with Core Research) rose sharply in January. While thinking on the economic outlook improved materially, this element saw a smaller rise from its December level than other aspects of the survey. A more constrained improvement in thinking on the general economic environment likely reflects ongoing concerns about the global economic outlook as well as elevated uncertainty about prospects for Ireland’s multinational sector.

The other ‘macro’ element of the sentiment survey, focussed on consumers’ views on the outlook for employment, improved slightly more than did the general economic outlook but still posted a slightly smaller than average gain in January, likely reflecting some cooling in the jobs of late and an associated uptick in unemployment.

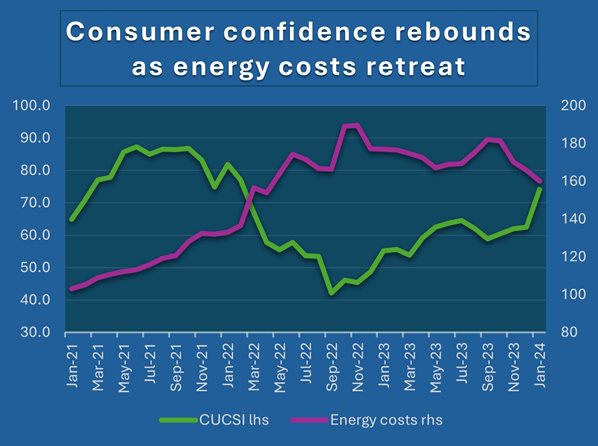

The two elements of the survey that saw the biggest gains between December and January were the backward and forward-looking assessments of households’ own financial circumstances. Our sense is that the recent turnaround in energy costs is a key driver in this regard as the diagram below illustrates.

The survey period saw a continued drop in oil prices, a spate of announcements of reductions in retail electricity and gas charges, media speculation on a grocery price war following some supermarket price cuts and ongoing speculation about a sequence of ECB interest rate cuts in the year ahead.

With increased tax credits and social welfare rates coming into effect at the start of the year and the payment of two €150 electricity credits in December and January, many Irish consumers will have a palpable sense of an increase in spending power as well as an easing in pressure on living costs of late. In these circumstances, it is not entirely surprising that the January survey saw an outsized improvement in consumers thinking on their personal finances.

As might be expected, big and broadly based gains in other elements of the survey were accompanied by a significant improvement in Irish consumers spending plans in January. However, it is probably more noteworthy that the increase in this element was altogether smaller than in the two others focussed on household finances.

The comparatively modest improvement in the buying climate suggests that most consumers will need altogether clearer evidence of a marked improvement in their spending power before they contemplate a sharp step-up in their spending plans. As such, the evidence of the January Credit Union Consumer Sentiment Survey (in partnership with Core research) appears consistent with a gradual build-up in household spending power through 2024 rather than an early year surge.

Section II; How do Irish consumers feel about their longer term economic and financial prospects at the start of 2024?

As usual, the January reading of the Credit Union Consumer Sentiment Survey (in partnership with Core Research) contained a number of special questions intended to shed light on current consumer thinking on particular topics.

At the start of another year, we again asked consumers to take a look further into the future to assess longer term prospects for the Irish economy and their own financial circumstances. We previously asked this question in 2022 and 2023. So, the results give a sense as to whether Irish consumer thinking on the longer-term outlook is stable or shifting.

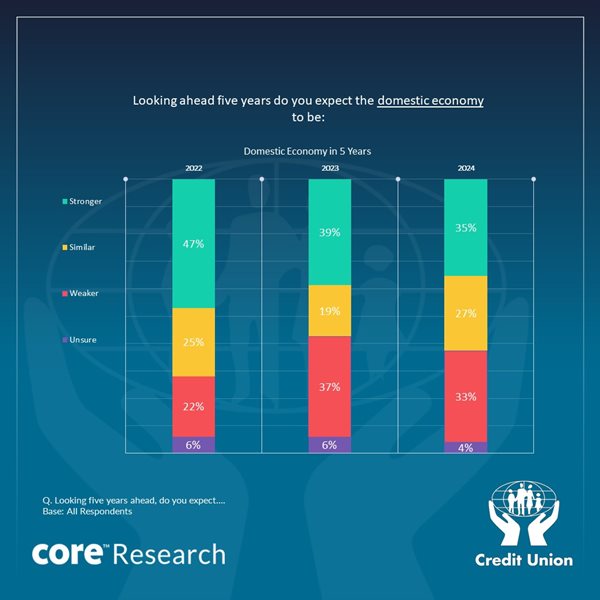

The diagram below compares consumer thinking on the longer-term fortunes of the Irish economy at the start of 2024 with their views of the past two years, a timeframe in which Covid concerns faded and cost-of-living pressures and economic uncertainty increased markedly.

The diagram above suggests that optimism among Irish consumers about longer-term prospects for the Irish economy has lessened in recent years, presumably as a much more threatening global outlook framed by a step up in war and a step-down in economic activity is seen as a lasting characteristic of the world to come. In addition, increased uncertainty about the future momentum of Ireland’s multinational sector likely led to fewer consumers expecting the Irish economy will be clearly stronger in five years’ time.

While fewer consumers now expect the Irish economy to be stronger in five years’ time than previously, there has also been a drop in those expecting the economy to be weaker compared to the 2023 survey. This hints at that consumers sense a greater capacity for the Irish economy to weather global economic storms than was feared a year ago.

In this context, it should also be emphasised that the overall results for 2024 suggest that, on balance, consumers expect the Irish economy to perform in broadly the same manner as at present. This could probably be considered a positive outcome given current strong trends in activity and employment. It is not entirely surprising that Irish consumers views of the future have been ‘scarred’ by the adverse shocks of recent years. Consequently, there is no sense in these responses that consumers envisage a return to ‘boom’ conditions. However, neither is there any sense that a permanent downgrade of Irish economic growth performance is widely envisaged.

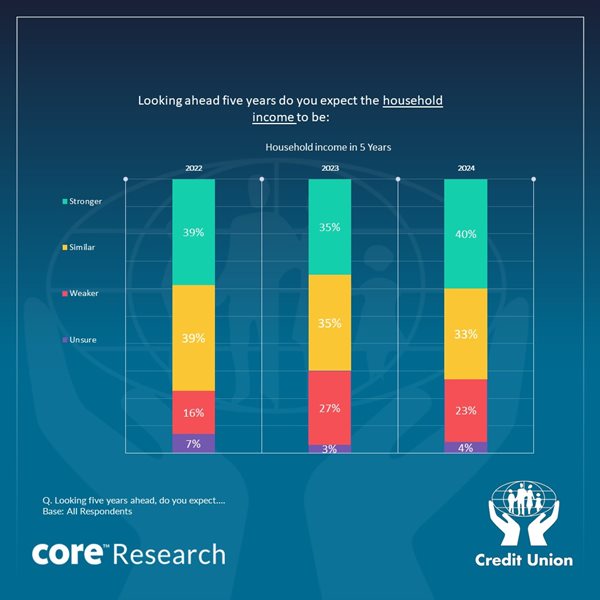

Although it may serve many purposes, the key rationale for strong economic growth is to deliver a broadly felt improvement in living standards. As there is often a disconnect between the reported performance of the Irish economy as a whole and the personal experience of consumers, the survey also asked how respondents thought their own household incomes would evolve over the next five years.

The responses to this question shown in the diagram below suggest that Irish consumers are notably more optimistic about the five-year outlook for their household finances than they were in 2023 when cost-of-living pressures seemed to threaten a lasting deterioration in living standards.

It is notable that in contrast to views in relation to the broader economy there is a marked ‘bounce-back’ in this element of the survey. Indeed, there is a fractional (but not significant) increase in the number of consumers anticipating higher household incomes than in 2022.

It should also be noted that while there is a full ‘bounce-back’ to Pre-Ukraine levels in numbers expecting stronger incomes in five years’ time, the drop in those seeing lower incomes is less pronounced. Those aged 55-64 are more likely to think their incomes will be lower in five years’ time, presumably reflecting the onset of retirement while those indicating they are making ends meet are also notably more pessimistic about their future prospects than other groups.

Our sense is that the overall improvement in thinking on the five-year outlook for household incomes in the 2024 survey compared to 2023 is largely the result of the recent easing in cost-of-living pressures (discussed above in our analysis of the January 2024 sentiment index).

It could also be argued that consumer thinking on prospects for household incomes has also been boosted by the influence of significant fiscal supports in the past couple of years. Implicit in these responses could be a view that fiscal actions may be needed as a counterweight to any adverse economic developments in coming years.

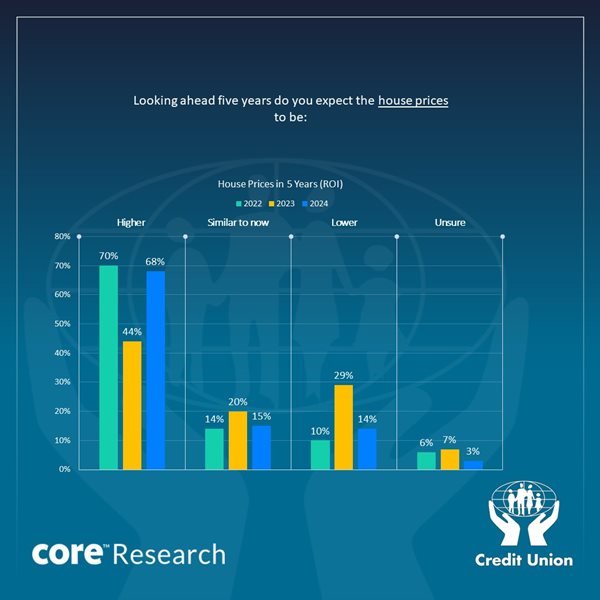

The January 2024 survey also repeated a question asked in the previous two years regarding consumer thinking on the outlook for Irish house prices. The results shown in the diagram below suggest that compared to the 2023 results Irish consumers are much more strongly of the view that house prices here will continue to grow over the next five years. Nearly five times as many consumers think house prices will be higher than think they will fall (68% of consumers V 14%).

The 2024 survey thinking on house prices is similar to that of 2022 and notably different to the 2023 results. With household incomes expected to improve and recent developments suggesting that cost- of-living pressures and borrowing costs may be less threatening in the medium-term than seemed likely a year ago, affordability difficulties may be less acute.

While these considerations might suggest continued strong demand for housing, consumers may also take the view that marked increases in supply may not be forthcoming notwithstanding the substantial improvement in housing completions in recent years.

The Credit Union Irish Consumer Sentiment Survey is a monthly survey of a nationally representative sample of 1,000 adults. Since May 2019, Core Research have undertaken the survey administration and data collection for the Survey. The survey was live between the 4th-19th January 2023.