September 2023 Consumer Sentiment Index NI | Published: 05/09/23

Northern Ireland consumer confidence improves again but most households still wary and worried about higher borrowing costs

-

Consumer fears ease slightly on resilient economy and lower oil prices

-

Uncertain outlook and financial strains mean northern Ireland consumers still cautious

-

Special Question focusses on impact of Bank of England rate hikes on Northern Ireland consumers

-

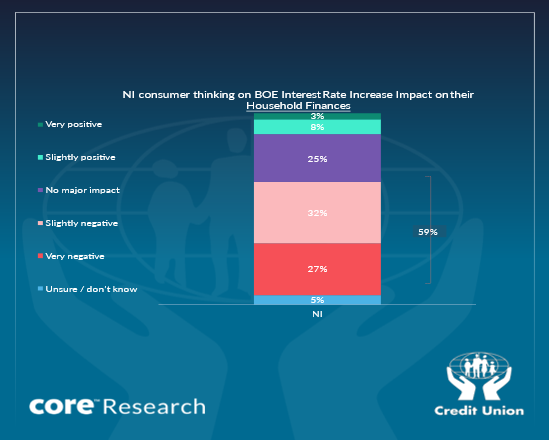

3 out of 5 consumers in Northern Ireland say Bank of England rate hikes are having a negative impact on their household finances

-

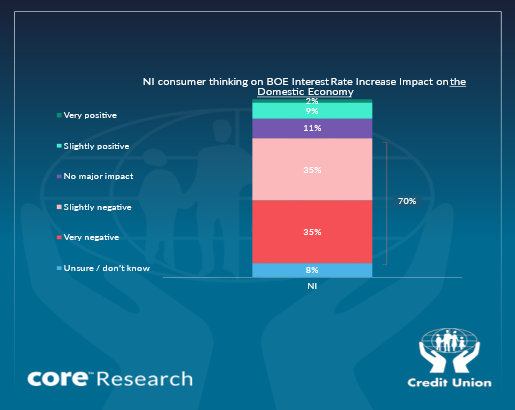

7 out of 10 say rate hikes are having a negative impact on the economy

-

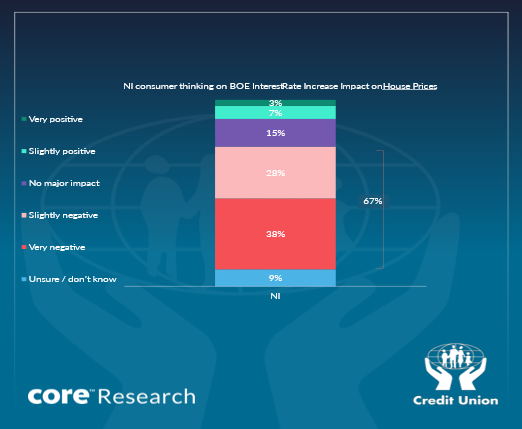

2 out of 3 say rate hikes will hit house prices

-

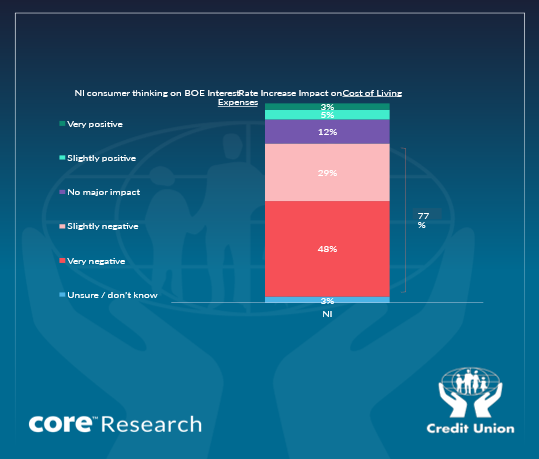

3 out of 4 see higher borrowing costs adding to cost of living pressures

Summary

Northern Ireland consumer confidence improved modestly further between April and August. Two factors appeared to have played a key role. First, the economy appears to have performed much better in early 2023 than had been feared or forecast and, second, global oil prices have softened somewhat, easing some of the still significant pressure on household finances and worries about winter heating bills.

The August 2023 Credit Union Northern Ireland Consumer Sentiment Survey hints that concerns about the cost of living and the threat of a severe economic downturn have lessened materially of late of late but economic and financial pressures are still pronounced for many households. So, the message of the August reading is one of a Northern Ireland consumer who is still cautious rather than carefree.

Section I; Consumer confidence continues to improve but significant concerns persist

Consumers in Northern Ireland remain worried about the economic outlook and their own household finances but, as was the case in the April reading, the August 2023 Credit Union Northern Ireland Consumer Sentiment Survey suggests these worries are gradually becoming less intense than they were through last winter. Four of the five main elements of the Credit Union Northern Ireland Consumer Sentiment Survey improved in August compared to April (and all were notably stronger than in January).

It should be emphasised that the responses given to the key questions in the survey suggest the mood of consumers in Northern Ireland is still fairly downbeat. This is to be expected as economic and financial conditions remain very challenging and an uncertain outlook carries significant risks.

For most northern Irish households, the past eight months has not proven quite as severe as had been feared. As a result, the Credit Union Northern Ireland Consumer Sentiment Survey is picking up small strands of relief in consumer thinking.

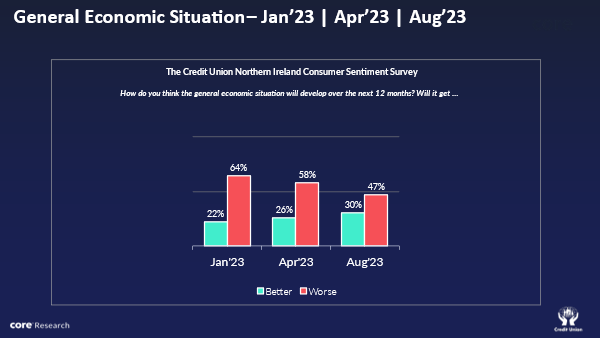

The most notable improvement across the main headings of the sentiment survey was in northern Irish consumers thinking on how general economic conditions might evolve over the next twelve months. Admittedly, as the diagram below illustrates, this came from a relatively low base as this was the weakest element of the Credit Union Northern Ireland Consumer Sentiment Survey in both previous readings.

In light of predominantly gloomy commentary on the local economy as well as the broader global economic climate, it is scarcely surprising that the August survey still contains markedly more negative than positive responses from Northern Irish consumers in regard to the economic outlook. However, as the diagram below illustrates, there has been a clear easing in the scale of concerns about the economy as 2023 progressed.

The improvement in consumer confidence has coincided with a much better than feared outturn for the local economy in the first quarter of the year, with the Northern Ireland Statistics and Research Agency’s (NISRA) composite economic index increasing 1.2% quarter on quarter to stand 1.9% higher than a year earlier. In turn, the greater economic resilience shown in early 2023 in Northern Ireland (as well as the UK and Republic of Ireland economies) has also prompted a progressive upgrade of economic forecasts that likely also caused Northern Irish consumers to be less pessimistic about the economic outlook.

Although the survey is signalling a clear improvement in consumer thinking, it is not suggesting that Northern Irish consumers are setting aside still serious issues relation to economic prospects. The change in consumer thinking on the economy is largely driven by a drop in the number of consumers with a negative outlook rather than by a rise in consumers with a positive outlook.

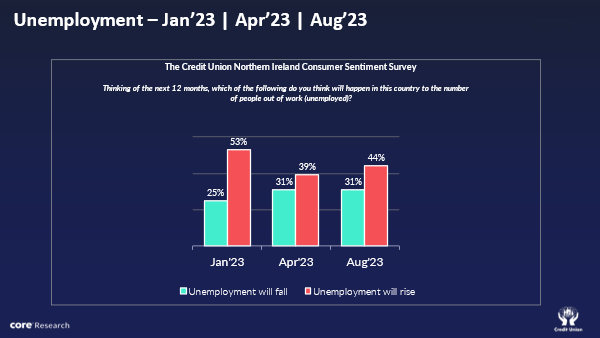

The one element of the Credit Union Northern Ireland Consumer Sentiment Survey that was weaker in August than in April was in regard to consumer thinking on the outlook for Jobs. Again, this result shown in the diagram below chimes with official data Labour Force Survey data that show a modest drop in employment in the second quarter of 2023, following a small rise in the previous quarter, as well as a marginal rise in unemployment.

Our sense is that consumer thinking on the outlook for jobs may also have been heavily influenced by some very high-profile layoff announcements through the survey period that hint at a notably more testing jobs climate, a development that is also signalled in official data indicating a marked pick-up in planned redundancies of late.

Although the weaker responses in the August survey suggest increasing concerns among Northern Irish consumers about the outlook for jobs, it should be pointed out that the tone of responses to this element of the survey is broadly more positive than to other survey questions. To a significant extent, this chimes with the pattern of relatively solid job creation and low unemployment evident in Northern Ireland for most of the past few years.

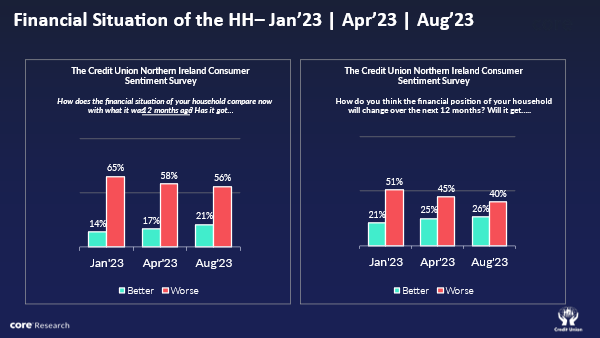

The Credit Union Northern Ireland Consumer Sentiment Survey found that consumers were less negative about their own personal financial circumstances in August than in April. Again, as the diagram below highlights, negative responses to these questions outnumber positive responses markedly. So, the August survey still suggests many Northern Irish households are facing significant financial strains. However, these strains appear to be easing somewhat of late.

The improvement in consumer thinking on household finances appears consistent with a slight softening in inflation in recent months and the particular impact of a pullback in global oil prices. As a recent Office for National Statistics study (Boosting the Northern Ireland price sample for the Consumer Prices Index, including experimental regional weighting. ONS 19 May 2023) indicated, the prevalence of oil-fired central heating in Northern Ireland homes mean inflation has been somewhat lower of late than the UK average and has likely declined faster through 2023. At the margin, it may also be that with less need to spend on light and heating through summer months, the improvement in this element of the survey could prove no more than a temporary respite.

With NISRA reporting that average employee pay in Northern Ireland was 7.5% higher in July 2023, this suggests that many households are now seeing an increase in ‘real’ or inflation-adjusted incomes. Again, this would be consistent with the improvement in the personal finances elements of the August survey. It would also accord with the fact that this was driven primarily by a pick-up in positive responses, possibly from those who had benefitted from increased wages of late. That said, given the large hit to spending power in the past couple of years, it is not surprising that the balance of responses to this survey question remains clearly negative.

As the diagram above illustrates, Northern Irish consumers were also somewhat less negative about the outlook for their household finances over the next twelve month in August than in April. However, this improvement was almost entirely driven by a drop in negative responses, with little change in positive responses. This combination of responses suggests growing relief that the worst may be over in terms of deteriorating household financial circumstances- but little sense that most households will see any dramatic improvement in their finances in the next twelve months.

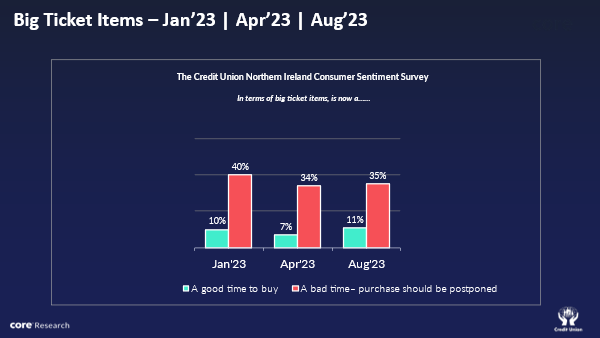

Not surprisingly, with conditions still challenging and the outlook uncertain, Northern Irish consumers remain cautious in their spending plans. However, there was a marginal improvement in the buying climate between April and August. Encouragingly, this was driven by a pick-up in positive responses suggesting the tentative emergence of a small group of Northern Irish consumers who may be both more willing and able to spend in the months ahead.

Although survey responses didn’t vary markedly across demographics, positive responses tended to be slightly more frequently seen on the part of males rather than females, those aged 25-44, and were also seen to occur more frequently among those reporting higher incomes. The gender differences are broadly consistent with those found in similar surveys for the Republic of Ireland, perhaps reflecting differences in risk appetite. Age and income-related differences in responses may stem from differences in labour mobility and related capacity to change one’s circumstances.

Section II; Bank of England interest rate increases, lots of pain, little gain?

Over the past year or two, there has been a dramatic change in interest rate policy around the world in response to the surge in inflation. To get some sense of consumer thinking on the likely impact of markedly higher borrowing costs, the Credit Union Northern Ireland Consumer Sentiment Survey for August asked a number of special questions about the perceived effects of the fourteen increases in policy rates by the Bank of England (BOE) since December 2021.

There is some debate among economists as to how successful or not interest rate policy may be in curbing inflation in the face of major shocks. However, there is a broader agreement that the process is likely to entail a fair measure of pain for the economy. This view was famously captured by the then British chancellor, John Major, who in 1989 suggested in relation to a sharp sequence of increases in UK official interest rates that ‘if it isn’t hurting, it isn’t working’.

One interpretation of the responses to special questions in the August Credit Union Northern Ireland Consumer Sentiment Survey is that consumers in Northern Ireland seem to feel that Bank of England rate hikes are hurting quite a lot, but they may not be working in terms of markedly reducing cost of living pressures.

Rate increases seen hitting household finances hard…

The diagram below shows Northern Irish consumers’ responses to the question as to the impact of Bank of England rate increases on their own household finances. As the table indicates, roughly 3 out of 5 Northern Irish consumers (59%) believe Bank of England interest rate increases have had a negative impact on their household finances while just one in nine (11%) say that the impact has been positive.

Census 2021 data indicate that 29.6% of households in Northern Ireland have mortgages. Recent research by the Institute for Fiscal Studies (Interest rate hikes could see 1.4 million people lose 20% of their disposable income. IFS 21/06/23) suggests that higher Bank of England rates mean an average increase in repayments for affected Northern Ireland mortgage borrowers of over £150 per month, with many more recent homebuyers seeing much larger increases.

However, many other households are affected by Bank of England interest rate increases. Responses to a special question in the April Credit Union Northern Ireland Consumer Sentiment Survey found that 15% of consumers would deal with an unexpected financial by borrowing from a bank or credit union through a loan or credit card debt.

Other distinct groupings are also likely to be adversely affected by interest rate increases. Those planning to buy a house will see their borrowing capacity reduced while renters may fear a knock-on impact towards higher rents. In addition, through the impact on asset values and discount rates, pension pots may also be hit- for many individuals with financial and/or other assets, capital losses may outweigh any boost from limited increases in deposit rates.

It is also likely to be the case that the number of Northen Irish consumers reporting a negative impact on their household finances from higher Bank of England interest rates is likely to be higher in circumstances where cost of living pressures are already hitting household finances quite hard and borrowing becomes a more important means of making ends meet.

….And rate hikes seen hitting the economy even harder

The August Credit Union Northern Ireland Consumer Sentiment Survey found that consumers were even more negative in their assessment of the impact of higher Bank of England interest rates on the economy as a whole than on their own household finances. As the table below indicates, 7 out of 10 consumers (70%) in Northern Ireland think higher Interest rates will damage the economy, with only 11% suggesting the impact will be positive.

These responses, suggesting a pronounced negative impact on economic activity are entirely consistent with the messaging from the Bank of England as to the painful impact of its tightening process. Indeed, one recent assessment (Expectations, lags, and the transmission of monetary policy - speech by Catherine L. Mann Given at the Resolution Foundation 23 February 2023) includes one estimate suggesting a 1 percent rise in base rates could cut UK GDP by 1.25 per cent, which given the scale and speed of Bank of England tightening would risk threatening a severe downturn.

Consumers feel rate hikes are harming rather than helping with the cost-of-living

The rationale for Bank of England interest rate increases that are likely to be painful for many consumers is to reduce inflation but economic theory suggests that this may not happen quickly but over a ‘long and variable’ timeframe. To get a sense of whether Northern Irish consumers expect a speedy restraining impact on the pace of price increases that matter to them, the August Credit Union Northern Ireland Consumer Sentiment Survey asked a more basic question-how Irish consumers thought higher rates would affect the cost-of-living pressures they faced.

The responses shown in the table above suggest that 3 out of 4 Northern Ireland consumers (77%) see higher rates adding to cost of living pressures, with just 1 in 13 (8%) saying higher rates would reduce cost-of-living pressures. This suggests the vast majority of Northern Irish consumers think the direct impact of higher borrowing costs will outweigh the more indirect restraining impact tighter Bank of England policy will have on demand and, consequently, on the pace of increase in consumer prices in Northern Ireland.

Higher rates expected to hit house prices

Finally, the August Credit Union Northern Ireland Consumer Sentiment Survey asked what impact higher rates might have on house prices. As the table below indicates, 2 out of 3 Northern Irish consumers (67%) think that Bank of England tightening will have a negative effect on house prices. This result appears consistent with the clearly softer trend in house price inflation seen through the past year that has seen Northern Irish house prices fall 0.7% in the six months to June 2023, although they are still 2.7% higher than in June 2022. Reduced borrowing capacity, coupled with a more challenging and uncertain economic outlook can be expected to weigh on housing demand.

At the margin, higher borrowing costs could also weigh on the viability of some new housing supply. This could be an element in some of the 9% of responses citing a positive impact. We should also recognise the possibility that some prospective house-buyers might see the prospect of lower house prices as ‘positive’ for them personally and may have framed their responses to this question in that light.

The Credit Union Northern Ireland Consumer Sentiment Survey is a quarterly survey of a representative sample of 350 adults. The research is undertaken, produced and published in partnership with Core Research. The August survey was live between the 4th and 28th August 2023.