February 2024 Consumer Sentiment Index NI | Published: 12/02//24

Northern Ireland consumer sentiment edges slightly higher on modest easing in cost pressures and mix

Northern Ireland consumer confidence improved marginally between November and January, sustaining a gradually improving trend through the past twelve months.

- Northern Ireland consumer sentiment marginally up between November and January

- Marginal gains in most areas suggest Northern Ireland consumers see small glimmer of light amid the gloom…...

- · …but limited pick-up in confidence also suggest that consumers feel their concerns may be easing but are still far from over

- Cost-of-living strains likely still weighing heavily on sentiment

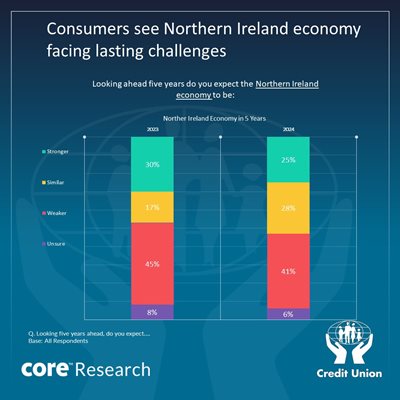

- Special questions suggests consumer thinking split on whether Northern Ireland economy will be stronger or weaker in five years’ time

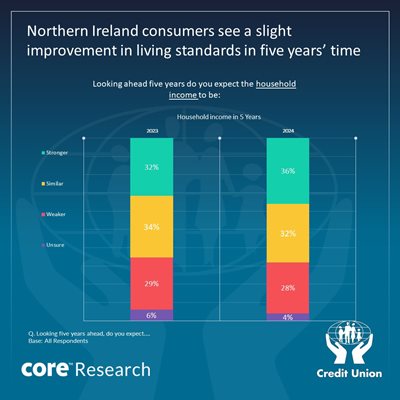

- Slightly more expect their household finances will be stronger rather than weaker in five years…

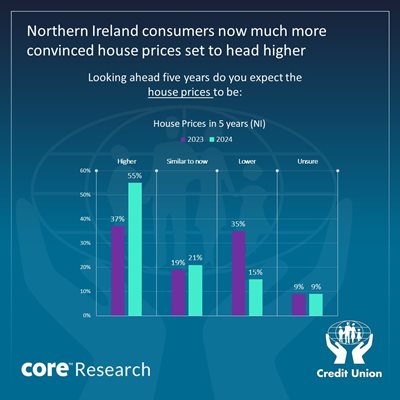

- · …but nearly four times as many consumers think Northern Ireland house prices will be higher in five years’ time as think they will be lower

Summary

Northern Ireland consumer confidence improved marginally between November and January, sustaining a gradually improving trend through the past twelve months. As a result, the mood of Northern Irish consumers is not nearly as nervous as it was in January 2023.

If the worries of Northern Irish consumers are easing somewhat, they are far from over. While there has been some softening in fuel prices of late, cost-of-living pressures remain elevated and recent public sector strikes serve both to emphasise the ongoing squeeze on households spending power as well as a difficult ‘macro’ climate.

As a result, sentiment among Northern Ireland consumers remains cautious and it has not improved to the same degree as it has for their counterparts elsewhere in the UK or the Republic of Ireland either in the latest quarter or over the past year.

Although Northern Irish consumers remain concerned about their economic and financial circumstances, the expectation of some further easing in cost pressures in the months ahead did contribute to a pick-up in spending plans that was also likely boosted by price cuts in post-Christmas sales.

Responses to a special question on the longer-term prospects suggest that consumers are evenly divided as to whether the Northern Irish economy will be stronger or weaker in five years’ time. Slightly more Northern Irish consumers are positive rather than negative on the five-year outlook for their own household finances but nearly four times as many consumers think Northern Irish house prices will be higher in five years than think they will be lower.

Section I; NI consumers notably less fearful but still far from cheerful in January 2024

The January 2024 Credit Union Northern Ireland Consumer Sentiment Survey (in partnership with Core Research) continues to signal a gradual easing in the severe nervousness that gripped consumers in Northern Ireland (and elsewhere) a year ago.

While developments in the interim may not have been as bad as had been feared, neither have they become markedly more positive of late. Pressures on household finances remain significant for most families in Northern Ireland and the broad economic picture remains weak and worrisome even if the downturn thus far has been less traumatic than widely predicted.

Mood of Northern Irish consumers slightly better of late but not boosted as much as consumers elsewhere

A slight uptick in Northern Irish consumer sentiment between November and January should be seen as a broadly favourable outcome although the general tone of the survey points towards a relatively subdued Northern Irish consumer. More significantly, it represents a clear underperformance of late relative to the results of other similar surveys.

The January 2024 Credit Union Northern Ireland Consumer Sentiment Survey (in partnership with Core Research) doesn’t show anything like the same degree of improvement of late as that seen in comparable surveys for the Republic of Ireland, the UK or the US, although it did fare better than Euro area consumer confidence where a slight drop overall was primarily driven by a larger deterioration in Germany.

In these other surveys, a fall in energy costs and expectations of lower inflation and cuts in interest rates in the course of 2024 seem to have triggered marked improvements in consumer confidence in recent months. Our sense is that the smaller uptick in Northern Ireland consumer sentiment of late may owe something to a less pronounced easing in fuel costs as well as the sharp focus that recent public sector strikes have put on living cost pressures and difficulties in domestic policymaking.

Economic gloom eases slightly

As is the case in other sentiment surveys, consumers in Northern Ireland remain concerned about the general economic outlook. The general thrust of the most recent economic commentary and forecasts of late has been to warn of an extended period of economic weakness ahead rather than any marked rebound.

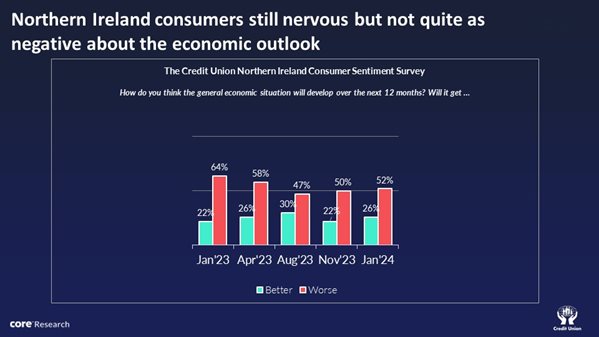

For this reason, it remains the case as the diagram below indicates, that almost twice as many Northern Ireland consumers expect the local economy to weaken as expect it to strengthen in the year ahead. However, as the diagram also suggests, this represents a slightly less negative balance of thinking than was previously the case and constitutes a clear improvement from a year ago when negative views outnumbered positive views on the Northern Ireland economy by almost three to one.

As is the case in many other surveys, the change in thinking on the part of Northern Ireland consumers through the past year (although not in the latest quarter) was primarily driven by a drop in negative thinking rather than a surge in positive views. This reflects the fact that although consumers worst fears about the economy have not been realised in 2023, it remains the case that economic conditions are very challenging. That said, it is worth noting that the improvement in the January 2024 survey was prompted by a slight uptick in positive views, hinting that some Northern Ireland consumers sense a small flicker of light in the economic outlook.

The slight improvement in sentiment towards the economy may have been triggered by signs of a resilient Northern Ireland economy in official economic data. The NI composite economic index (prepared by the Northern Ireland Statistics and Research Agency) showed a 0.6% quarterly rise in the third quarter of 2023 that compares favourably both to a drop of 0.1% in UK GDP and a flat outturn in modified domestic demand, the most commonly used measure of domestic economic activity in the Republic of Ireland in the same period. A comparison of the same measures also points to a clear outperformance by the Northern Ireland economy between the third quarters of 2023 and 2024.

Job fears ease somewhat on continuing employment growth

The resilience in economic activity in Northern Ireland through much of 2023 translated into continued gains in employment in official data despite a marked worsening in layoff announcements.

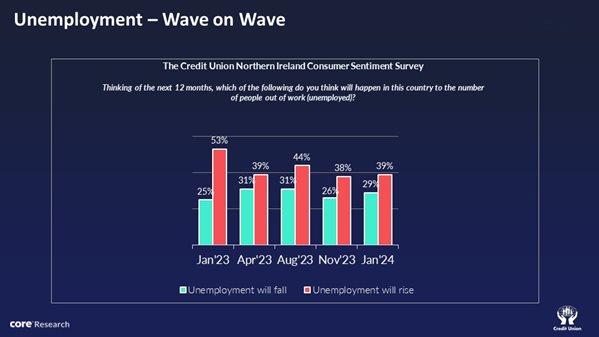

In turn, very mixed news on the jobs front appears to have caused Northern Ireland consumers to remain nervous but marginally less so in relation to the outlook for unemployment in the January 2024 Credit Union Consumer Sentiment Survey for Northern Ireland, as the diagram below illustrates.

Against a general backdrop of ongoing negative risks to the economic outlook, it is not at all surprising that more Northern Ireland consumers think unemployment will rise rather than fall in the

next twelve months. A sharp rise in notified redundancies through 2023 further points in that direction. However, it is encouraging that the January 2024 survey saw a marginally less negative balance overall on the outlook for jobs.

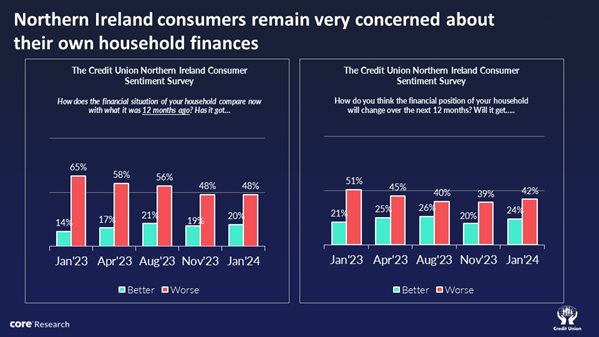

Household finances remain a sore point for consumers in Northern Ireland

As noted above, the improvement in the Northern Ireland Consumer Sentiment Survey has not been as strong as that seen in similar surveys elsewhere. In the main, this is due to a less pronounced improvement in thinking about consumers’ own personal financial circumstances in the Northern survey than elsewhere.

As the diagram below illustrates, thinking on household finances has changed little in recent months notwithstanding a softening in global energy prices, an easing, albeit uneven, in inflation and expectations for lower interest rates and some tax cuts in the year ahead.

The evidence of other consumer sentiment surveys suggests that a change from circumstances of accelerating increases in living costs to one of slower increases and in some cases falling prices has had a marked impact on consumer thinking of late. Several reasons might be suggested why more favourable price dynamics has not had anything like the same positive impact on the thinking of Northern Ireland consumers that it had elsewhere of late.

One possibility is that the strain imposed on household finances in Northern Ireland by the surge in living costs is more severe than elsewhere. This is partly because incomes are comparatively low on average in Northern Ireland. So, there is less capacity to handle a continuing rise in living costs even if the pace of increase is slowing.

We would also note that while motor fuel costs in Northern Ireland fell broadly in line with those elsewhere, survey data also suggest there was some firming in home heating oil costs in Northern Ireland between November and February. Given a seasonal peak in demand for home heating, it would not be surprising to see Northern Ireland consumers strike a comparatively gloomy note for this reason.

Another differentiating factor is the role of fiscal supports. In the Republic of Ireland, consumers have benefitted of late from a range of electricity support payments, double welfare payments, higher social welfare benefits and increased tax credits that boosted household spending power from the start of the year. In contrast, higher taxes on energy and hospitality saw a marked weakening in the latest German consumer confidence reading.

While the latest survey reading suggests Northern Ireland consumers are not as negative regarding the prospects for their household finances as they have been, neither is there any palpable sense that current cost-of-living pressures will soon abate. In this context, it could be suggested that recent high profile public sector strikes and the associated focus on shortfalls in pay likely reinforced concerns around the spending power of Northern Ireland consumers.

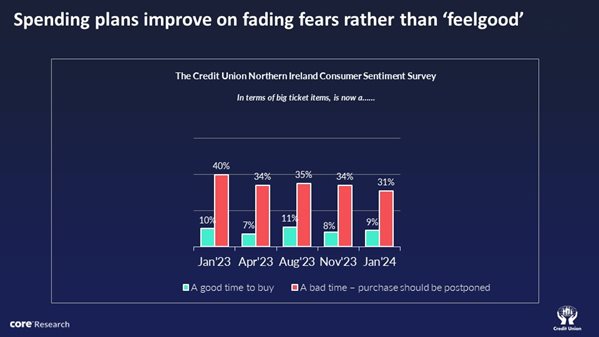

Uptick in spending plans suggests Northern Irish consumers may be down but they’re not out

If the tone of some elements of the January 2024 sentiment survey suggests that Northern Ireland consumers may be down, there is little indication that they are entirely out. While most aspects of the survey showed marginal gains, there was a somewhat larger if still modest improvement in spending plans as the diagram below illustrates.

This is clearly encouraging but, given the more subdued nature of other survey headings, coupled with the fact that it was driven largely by a drop in negative responses rather a clear rise in positive

responses, this shouldn’t be interpreted as pointing towards a marked uplift in spending by Northern Irish consumers. Our sense is that this particular result may be driven significantly by an intention to take advantage of price discounting in post-Christmas sales rather than signalling a more permanent step-up in spending

Section II; How do consumers in Northern Ireland feel about their longer term economic and financial prospects at the start of 2024?

As usual, the January reading of the Northern Ireland Credit Union Consumer Sentiment Survey (in partnership with Core Research) contained several special questions intended to shed light on current consumer thinking on particular topics.

At the start of 2024, we asked consumers, as we did in 2023, to take a look further into the future to assess longer term prospects for the Northern Irish economy and their own financial circumstances. So, the results give a sense as to whether the thinking of Northern Irish consumers on the longer-term outlook is stable or has shifted in the past year.

We first asked consumers about the general outlook for the Northern Ireland economy. The results shown in the table below suggest many consumers see the Northern Irish economy facing lasting difficulties with only 1 in 4 consumers (25%) expecting the economy to be stronger in five years’ time, a slightly smaller number than were positive in the January 2023 survey. While the share of consumers expecting the Northern Irish economy to be weaker in the medium-term is also slightly lower than last year, the balance of responses is marginally more pessimistic than in 2023 and clearly suggests Northern Irish consumers see enduring challenges for the local economy.

The January 2024 Credit Union Consumer Sentiment Survey for Northern Ireland also asked consumers how they envisaged their own household incomes would look in five years’ time compared to today. The diagram below compares these responses to those given in the January 2023 survey.

Encouragingly, there is a slight improvement in the thinking of Northern Ireland consumers as to how their personal finances will change in the next five years. That said, considering current negativity, the small improvement envisaged over this lengthy timeframe suggests consumers fear current cost-of-living pressures will be slow to fade. In this context, the fact that the number expecting their household finances will be weaker in five years’ time is effectively unchanged in the past year and reasonably large at 28% of consumers might be seen as troubling.

Finally, we asked Northern Ireland consumers how they felt house prices might evolve over the next five years. As the diagram below illustrates, the thinking of Northern Irish consumers has changed materially in this respect in the past twelve months.

In the January 2023 survey, opinion was almost evenly divided as to whether Northern Ireland house prices would rise (37%) or fall (35%) on a five-year view. In the 2024 survey, nearly four times as many consumers think house prices will be higher in five years’ time than think they will be lower (55% vs 15%). This chimes with the evidence of continued strength in Northern Ireland house prices (up 2.1% y/y in Q3 2023) in contrast to declining house prices of late in England and Wales.

The Credit Union Northern Ireland Consumer Sentiment Survey is a quarterly survey of a representative sample of 350 adults. The research is undertaken, produced and published in partnership with Core Research. The January survey was live between the 4th and 18th January 2024.