November 2023 Consumer Sentiment Index NI | Published: 28/11//23

Northern Ireland consumer sentiment holds steady but points towards a cautious rather than carefree Christmas spend

Having improved in the previous two quarters Northern Ireland consumer confidence held broadly steady between August and November. In circumstances where similar consumer confidence measures for the UK as a whole, as well as the US and the Euro area, have fallen through the past three months, this should be seen as a reasonably encouraging performance.

That said, the mood of Northern Irish consumers remains subdued as concerns about the general economic environment and the cost-of-living crisis remain to the fore. In these circumstances, it is not surprising that consumers were a little more negative about the prospects for their household finances over the next 12 months. Consistent with this elevated caution and increased seasonal demands on spending, Northern Irish consumers pared back their spending plans.

A marked element of caution in the November Northern Ireland Consumer Sentiment survey in relation to the outlook for personal spending power and spending plans was also reflected in responses to special questions on Christmas spending. 1 in 2 Northern Irish consumers say they have less money to spend on Christmas than twelve months ago and plan to cut back on presents and going out as a result.

Section I

NI consumer sentiment holds steady but continuing concerns make for mixed messages in survey

The November 2023 Credit Union Northern Ireland Consumer Sentiment Survey (in partnership with Core research) suggests that while the worst fears of a year ago have now faded, economic uncertainty and pressures on family finances remain important concerns for most Northern Ireland consumers. Although there are grounds to suggest that the broad picture of confidence holding steady represents a relatively positive outcome, the prevailing mood among Northern Irish consumers is still quite subdued.

The November Credit Union Consumer Sentiment Survey for Northern Ireland doesn’t continue the improving tone seen in the April and August readings, but this must be seen in the context of pronounced weakness in similar confidence measures for a range of other countries in recent months. In the US, consumer sentiment has fallen in each of the past four months, in Germany consumer confidence is seen hitting a seven-month low in November, and while readings for the UK as a whole have been choppier, confidence has also been comparatively weak since the summer.

A sense that while the worst may be over, what lies ahead may not be altogether better seems to inform the mood of consumers around the globe. Concerns about the global economy remain elevated. A possible large and lasting impact from recent atrocities in the middle east has become the latest source of uncertainty and unease.

Importantly, while the rate of inflation has eased globally, for most consumers, this doesn’t’ mean that the sharp surge in living costs is being reversed. It simply means that their cost of-living is being reversed. With little to suggest any looming upswing in the global economy or downturn in prices, this suggests the ‘new normal’ could be challenging for most consumers globally.

Judged from this perspective, the broadly steady reading for Northern Ireland consumer sentiment should be seen as encouraging. That said, it does signal renewed concern about the general economic outlook, which was the weakest element of the November survey by some distance. This is scarcely surprising.

Although recent months have seen economic growth forecasts for the UK economy upgraded for 2023, there has been a disappointing downgrade to the outlook for 2024. The new forecasts in the November consensus compiled by the Treasury shows UK GDP is now expected to growth by 0.5% in 2023 and just 0.4% in 2024.

In the same vein, the possibility of a recession in the Republic of Ireland has commanded significant media attention of late. With economic winds in Northern Ireland’s two key trading partners blowing in the same direction, it is scarcely surprising that consumers in Northern Ireland would be more downbeat on economic prospects.

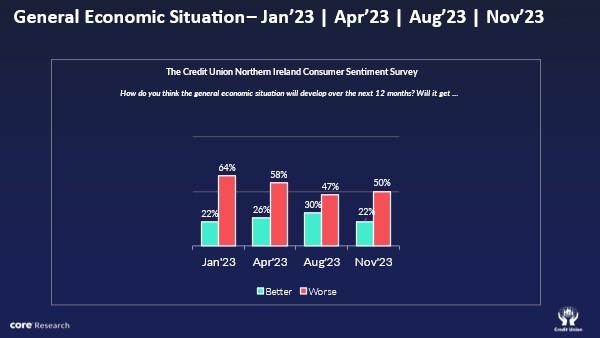

As the table below indicates, weaker sentiment on the economic outlook was primarily driven by a drop in the number of Northern Irish consumers who believe the economy will improve in the next twelve months although there was also a small increase in the number expecting a further weakening.

As the table indicates, over the four readings of the Credit Union Consumer Sentiment Survey for Northern Ireland during 2023, there has been a clear easing in the number of consumers who expect economic conditions will get worse but no major increase in the number of consumers who expect a material improvement.

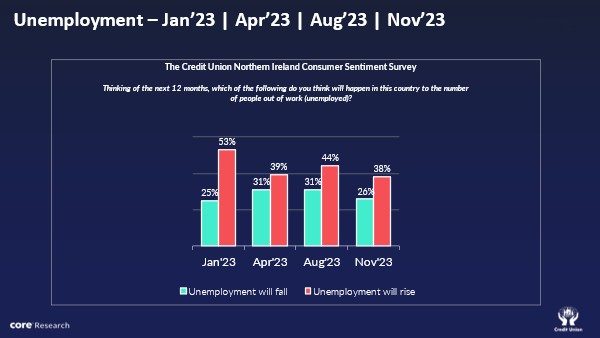

Encouragingly, as the table below indicates, Northern Ireland consumers did not mark down their views on the outlook for employment in the November survey. This likely reflects the continuing strength in the local jobs market (and mirrored to varying degrees in other economies).

The survey period saw the release of labour market data that showed employment in Northern Ireland was 0.9% higher in the third quarter of 2023 than the previous quarter and 2.7% or 23,000 higher than a year earlier. At the same time, the unemployment rate in Northern Ireland fell to just 2.1% compared to 3% a year ago.

While redundancy notices continue to run at a notably higher level than in 2022, it seems that consumers in Northern Ireland are aware of the generally positive momentum in the local jobs market and see this significantly countering the lacklustre outlook for economic growth.

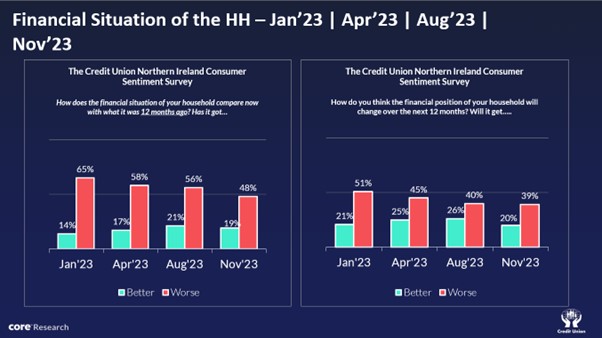

The most notable improvement between August and November readings of the Northern Ireland Consumer Sentiment Survey was seen in consumer thinking on how their household finances had developed through the past twelve months, as seen in the table below. This was driven by a notable drop in the number of consumers saying their household finances had gotten worse. There has been no pick-up in the number of consumers reporting an improvement in their household finances.

Our sense is that consumers have drawn some relief because the surge in the cost of living and, particularly, in energy prices seen in the latter stages of 2022 has not been repeated of late. Instead, slowing inflation and a growing sense that interest rates may have peaked may have encouraged the view that the worst could be over.

However, as the table above also illustrates, if Northern Ireland consumers seem to be considering that the worst may be over, they also seem to be contemplating the possibility that what follows may not be dramatically better. This result was driven by a drop in the number of consumers expecting their household finances will improve in the next twelve months. Still strained household finances and a recent firming in energy costs could be informing a view that living costs may continue to increase in a manner that will put persistent pressure on the finances of many households.

Volatility in oil prices could be an important element in shifting thinking on household finances. While the recent trend in global energy costs has been much less threatening of late than it was a year ago, a firming in motor fuel and heating oil prices since the summer suggests many Northern Irish consumers will continue to face challenges in making ends meet each month.

It should be noted that the results for the November Credit Union Consumer Sentiment survey results (in partnership with Core Research) regarding thinking on past and expected trends in household finances are broadly consistent with those reported in the Northern Ireland Consumers & the Cost of Living - Pulse Survey September 2023 produced by the Consumer Council. The consumer council results for September are very close to the Credit Union Consumer sentiment survey data from the August survey.

Combining the survey results hints that Northern Ireland consumers have become a little less negative about the recent trend in their household finances, but fewer consumers now think their household finances will improve in the next twelve months than was the case a few months ago.

An uncertain economic outlook and continuing pressure on household finances could also be expected to weigh on the spending plans of Northern Irish consumers and, as the table below indicates, the buying climate has weakened slightly in the November Credit Union Consumer Sentiment Survey. In addition, a pullback in spending plans may simply reflect the pressures a notably increased seasonal outlay on light and heating place on spending power.

Two other less negative influences could also be contributing to the pullback in spending plans in the latest survey reading - it is worth emphasising that financial circumstances and drivers of sentiment vary widely across the spectrum of Northern Irish consumers. One possible explanation of softer spending plans in November is that some consumers may be temporarily curbing spending ahead of increased outlays over the Christmas period. Given the timing of the November survey, there may also be some element of consumers delaying spending until the full array of ‘Black Friday’ price discounts appear.

Section II.

Northern Irish consumers spending plans for Christmas 2023.

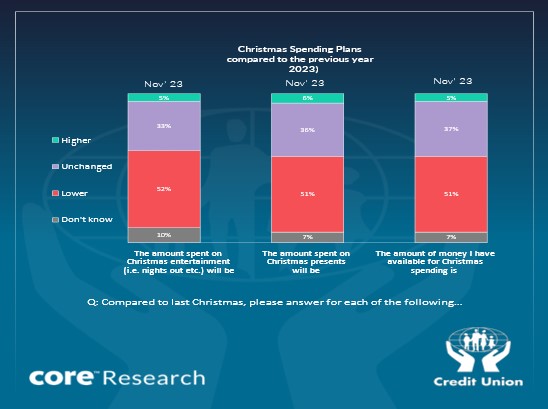

The Northern Ireland Credit Union Consumer Sentiment survey (in partnership with Core Research) for November contained a special question focussed on Northern Irish consumers spending plans for Christmas 2023.

Although inflation may easing, many consumers in Northern Ireland are likely to find that the cumulative and continuing rise in living costs seen through the past two years will markedly reduce their household’s discretionary spending power this Christmas. As a result, it is not surprising that many households say they must make further adjustments in their spending to ensure Christmas is affordable for them.

As the diagram below indicates, just over half of Northern Irish consumers (51%) expect to have less to spend than last Christmas, while only 1 in 20 of consumers (5%) say they have more to spend. These results are very similar to those reported in this month’s Credit Union Consumer Sentiment survey for the Republic of Ireland. As such, they emphasise the global nature of the cost-of-living challenges that households now face.

The impact of higher household bills and pre-committed spending through the past couple of years means there are significant demographic variations in Christmas spending plans particularly those aged over 55 were more notably likely to say they have more to spend this Christmas than those aged between 25 and 55. Consequently, older consumers say they are far less likely to cut back on Christmas-related spending that those aged under 55.

We think this reflects the greater impact of notably higher household bills and child-related costs on ‘family-focussed age groups who probably find more of their income is pre-committed on various elements of spending ranging from housing to education and entertainment related to their families.

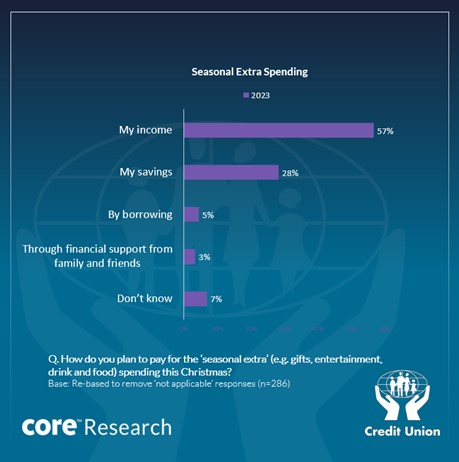

The November Credit Union Consumer Sentiment Survey also asked Northern Irish consumers how they planned to finance their Christmas spending. Just over half of consumers (57%) say they will rely on their current incomes while about a quarter of consumers (28%) say they will use savings. Very few consumers-just 1 in 20 (5%)- say they will borrow to finance their spending this Christmas. A not negligible 7% of consumers say they don’t know how they will fund their Christmas spending, suggesting quite a number of households are not able to say if or how extra seasonal spending can be afforded.

The Credit Union Northern Ireland Consumer Sentiment Survey is a quarterly survey of a representative sample of 300 adults. The research is undertaken, produced and published in partnership with Core Research. The November survey was live between the 4th and 21st November 2023.